Hi Everyone,

You can order groceries to be delivered in as little as an hour. You can purchase a car at your convenience through the tap of a button. How about your home? Today we will breakdown Opendoor (IPOB), a company aiming to disrupt the real estate market.

Business Summary:

Opendoor is a leading digital platform company focused on the process of selling and purchasing a home. The company leverages software, data science, product design, capital markets and operations to renew the service model of residential real estate. With a few taps on your phone or website you can conduct one of most important life transactions of your life. The digital on-demand experience aims will reinvent the way one transacts their home. Sellers can go to the website and receive an offer and close at their convenience. Buyers can use the app to tour the home, identify financing options, and make an offer through one technology source. Uncertainty is removed during the transaction process. The company initially launched in 2014 in Phoenix and has expanded to 21 major metropolitan markets (Atlanta, Dallas, Denver, Houston, Los Angeles, etc). Opendoor offers the following features:

“A modern way to sell”: Sellers can receive a cash offer seamlessly with quick and easy platform experience.

“A modern way to buy”: Through “Buy with Opendoor” on the app, buyers can tour the home, shop for financing, and present a market offer without agents

“A modern way to move”: Trade-In product is integrated that allows customers to buy and sell homes in a coordinated transaction. This eliminates resale contingencies, double moves, and double mortgages

“A digital one-stop-shop”: Title and Escrow services and home loans. Company provides title insurance for 80% of Opendoor homes and through the platform access more transparent mortgage process

Technology Features: The end-to-end platform incorporates data science capabilities, and technology to aggregate hyperlocal data to offer a seamless service.

Proprietary Offline Data: 150,000 home assessments that resulted in collecting 100 data points on each home. Proprietary home level data through visitor feedback, traffic, and duration of visits is collected. This data has then created 1 billion annotations and corrections to MLS data and created new values in geospatial data assets.

Pricing Accuracy: Pricing algorithms utilizing ML to fully automate home valuations. Drivers for the pricing algo involve demand forecasting, outlier detection, risk pricing, and inventory management.

Low-Cost Transaction: The custom ground-up built of the platform has allowed the company to transact 100 homes per day. A network of local service providers has been created driving down the cost of materials employed in-home repair process and ensuring homes are well maintained, clean and safe.

The company’s goal is: “to build the largest, most trusted platform for residential real-estate and empower millions of Americans with the freedom to move”

Industry:

Residential real estate is one of the largest markets that has remained to date undisrupted. The typical process of buying or selling a home is complex. In addition to complexity, housing is the single largest consumer expense relative to transportation, food, and healthcare. A traditional home sale requires layers of decision making, unexpected costs, and on average can take three months to complete the full process. The following current problems exist in the market that Opendoor aims to solve:

Residential Real Estate is a large offline market: online penetration is less than 1% of home transactions

The current market is fragmented: 90% of transactions involve agents with over two million licensed agents in the market. Inconsistent and frustrating experiences are common.

The industry will experience a shift to the digital world. Greater efficiency, certainty, and speed are a demand for 72 million digitally savvy millennials. Digital-first experiences are on high demand as is evident with transportation, food, and healthcare.

Market Opportunity:

The total addressable market across residential real estate is estimated to be around $1.6 trillion. In 2019 there were approximately 5.3 million home sales of existing homes, with a median home price of $271K. Now 1% of transactions across the market are digital and since Opendoor’s launch, they have bought and sold over 80,000 homes representing 2% of the market. This by default makes them a market leader currently with massive upside for market share control.

Business Model Landscape:

The company is in the business of buying and selling homes. Majority of the revenue is driven by home sales. Revenue is expected to increase through adjacent services such as title and escrow services, listing fees, and home loans. The acquisition to resale process takes about 90 to 110 days for Opendoor and seamless experience for the buyer or seller.

Offer: Cash offers are algorithmically generated. Free assessment of home and repairs is also conducted through the platform before purchase agreement and final offer. The business model is designed to generate margins from the service charge to sellers (6-9% fee), and ancillary products associated with the transaction. The spread between acquisition price and resale price is not part of the business model

Acquisition and Repair: Vetted contractor network is utilized to conduct any repairs or upgrades to ensure high returns and market-ready condition of the home

Home Resale: The pricing engine is a key component to help the listing and market process. The pricing engine automates inventory performance in local market, demand signals, and sell-through in the portfolio to maximize resell margin

The following customer landscape is created based on the service Opendoor offers:

In 2019 19,000 homes were sold and 80,000 homes since 2014

>560,000 consumers requested an Opendoor offer

Opendoor homes were visited over 1.6 million times

The company has expanded from 6 markets to 21 markets maintaining covering 1.1 million potential home sales.

1.7% current market share across all markets with 4.6% market share in Atlanta

Strong conversion with 34% of real sellers choosing Opendoor when given an offer

Customer Service rate has an NPS score of 70

6% service charge, 1 in 2 real sellers choose Opendoor to sell home

10% service charge, 20% real sellers choose Opendoor

Competitive Strengths (Moats):

The company aims to make moving a seamless process. According to the SEC filings, Opendoor has identified a series of advantages.

Platform: The company has built a low-cost platform with the customer’s experience in mind. The process of buying and selling home has been reduced from a typical three-month process to a matter of days through the app and website. The platform is collecting offline data using its data science and application capabilities and provides automated, accurate pricing for homes.

Experienced Management Team: The CEO and the team have significant experience in software and real estate. They focus on the power of data and building a platform that scales with ease. Additionally, the merger with the SPAC (IPOB), sponsored by renowned investor Chamath Palihapitiya, brings an additional level of experience in building a 10x company.

Market Share: The company is a market leader with 2% overall share in a market that has not yet been disrupted. Being first with a platform that intends to create purchasing a home as easy as buying a car sets it up for continued growth and market expansion. They intend to expand from home selling to controlling the entire value process relating to real estate transactions.

One-Stop Shop: Attaching additional services to the platform will increase the value to customers. Title and escrow, home loans, direct sale offering listing service, network of vetted contracts for repairs are all components that increase customer experience and built a centralized platform to access the entire home transaction process.

Favorable Market with low-interest rates and appreciating home prices: The FED’s current policies have placed interest rates to zero and created a surge in demand for purchasing homes in a market with limited inventory. This has appreciated prices and injected strong demand in the market.

Competition/Risks:

The company has highlighted certain competitive and operational risks that may affect its performance.

Competition: The company’s main competitor is Zillow Offers. Zillow makes a cash offer within 48 hours and provides required repairs for a 6-8% fee. The owners however are responsible for closing costs and transfer fees.

Downturns in Real Estate Market: Currently 47% of the revenue is generated from only 4 markets (Phoenix, Dallas, Atlanta, and Raleigh). A decline in real estate value, limited inventory, and other market trends can adversely affect performance. Downturns in the seasonal and cyclical real estate market and government regulations can pose a drastic risk.

Trend to purchase/sell a home online: Purchasing a home is often a life-changing event filled with emotions. Selling a home also involves a lot of subjective emotions regarding fair market value. While the process today is complex and fragmented customers on both sides of the transaction must perceive significant value specifically in price and ease of use to shift to the digital world. One-stop-shop experience is key.

Inventory Management: Revenue is dependent on available inventory for sale. Pricing needs to adjust to being in line with market trends to attract customers to sell. Events like Covid-19 halted home sales initially creating a reduction in inventory and impacting sales.

Debt is heavily used to operate a business: As of June 30, 2020, $587 million of principal debt outstanding and $393 million of asset-backed loans. With potential risks to the real estate market, any unforeseen market trends can negatively impact earnings and cash flow. This can create a material difference in paying the debt.

Team:

The company’s founders and executive team are veterans in the software and real estate industry.

Eric Wu, Co-founder, and CEO: Prior, Eric founded and served as CEO of Movity.com, geo-data analytics company acquired by Trulia, and co-founded RentAdvisor.com, an apartment search company that generated leads.

Carrie Wheeler, CFO: Ms. Wheeler was with TPG global, a global private equity firm heading consumer and retail investing.

Ian Wong, Co-founder, and CTO: Prior Ian, was a software engineer at Prismatic, Inc., a social news discovery company, and as an inference scientist at Square.

Chamath Palihapitiya, Founder, and CEO of IPOB: Chamath is an influential investor who revived the resurgence of SPACs through the merger with Virgin Galactic. He also served as director of Slack Technologies and is the founder of Social Capital. His goal is to invest long-term in companies that will disrupt their respective industries. He is personally contributing $100M to the deal.

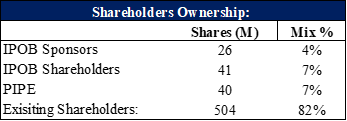

The following ownership structure post-merger will be present:

Financial Performance:

The company post-merger with IPOB will have an Enterprise Value of $4.8 billion representing 1.0x 2019.

The company has achieved $4.7 billion in revenue for the year 2019, a (158%) increase over the $1.8 billion earned in 2018. More recently the company earned $1.9 billion in six months ended 06/30/20 resulting in a (-12%) YoY from $2.2 billion. The drop in sales in 2020 was related to the COVID economic shutdown. However, the company has maintained a 145% CAGR regarding homes sold and 159% CAGR regarding revenue.

As of 12/31/2019, and 2018, the company’s net losses were $341 million and $241.3 million. Gross Margins for the business as of 12/31/2019 were around ~6.4% and the adjusted contribution margin after interest was around 0.6%. It is expected that the company will maintain a CAGR of +95%.

The company has also generated an AEBITDA loss of $217.9 million in 2019. More recently they have also maintained a -2.5% AEBITDA remaining unprofitable since 2014. As market share expands, margins will improve since the company has achieved unit economics. By 2023 the company is predicting that they will be profitable.

The company provides the following forecasts:

Revenue - 2023E: $9.8B (58% growth rate)

Contribution Margin – 2023E: $458M (4.7%)

Adj EBITDA – 2023E: $9M (0.1% margin)

Firm Value / Revenue – 2019: 1.0x / 2023E: 0.5x

The company will have $1.5B in cash post-merger

Opendoor plans to continue growth through the following strategies:

Increase penetration in existing markets: Drive growth and penetration in the market to expand 2% market share. 6% of sellers in the market received an offer from Opendoor. Marketing, platform innovation, and brand awareness are key

Expand to new markets: Identify markets with demand, and housing supply and reach the top 100 markets in the US. Centralizing of pricing, and operations ensure scalability

Expand product and service offering: Offer tech enable title insurance, home insurance, home warranty, moving and storage, and home repair and maintenance

-Igli

You can access and download the detailed report here which will include the summary and a company info-graphic. If you like the content please make sure to share this newsletter, share this post, or subscribe (if you have not already)!