⚡This is Equity Breakdown, where you will find short, no bullshit overviews of public companies! Join me in breaking down industries and companies that will become leaders embracing disruptive technologies and innovating change! Subscribe Now!

“Compound interest is the eighth wonder of the world.” - Albert Einstein

To all the Time Investors,

Gaming is eclipsing the entertainment industry and surpassing traditional streaming services. Within this $161 billion market, the fastest growing segment is mobile gaming. Today we will breakdown, Skillz ($SKLZ). The company that is aiming to tap into the competive nature of gamers and transform the future of electronic gaming.

🔴Download Equity Breakdown Report

📖What is Skillz?

Skillz provides a platform for users to socially compete and watch multi-player esports games.

The company empowers developers to share their creations and for gamers to compete. The company is creating an gaming ecosystem that fuels the “competition layer of the internet”.

The company offers three types of games:

Gamers can play the exact game at different times and then scores are compared

Gamers can play a multi-player game where they take turns (like chess) and then a winner is determined at the end

Gamers can play live making moves simultaneously between each other and then a winner is determined at the end

Now top games on the platform alternate year by year. In 2020, the top three games were Solitaire Club, 21 Blitz, and Blackout Bingo.

The three key values the company continues to reiterate are trust, fairness, and competition when building their ecosystem.

📈Market Opportunity

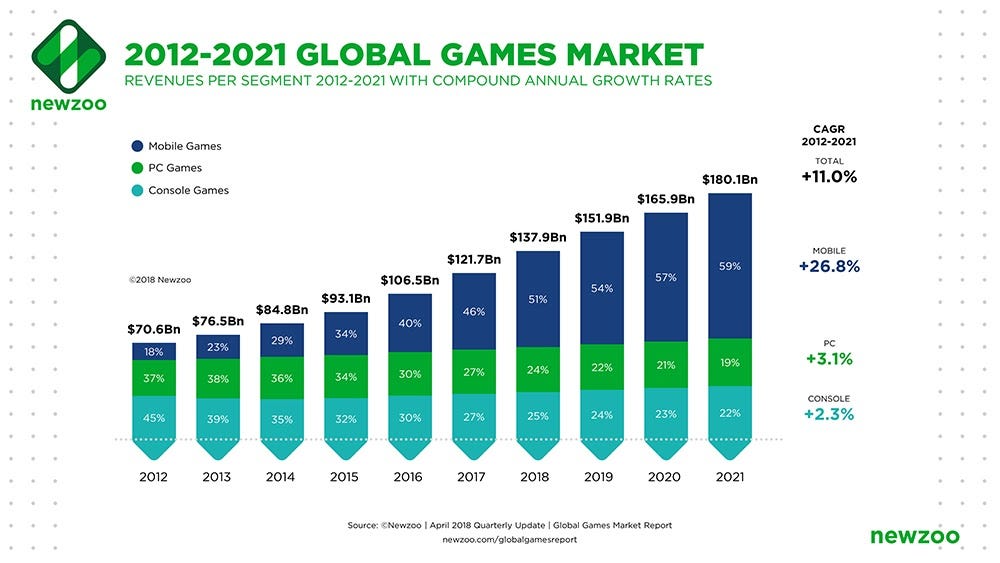

According to Statista, over half the world’s population uses smart phones and based on additional studies around 33% of app downloads are games and within those games users allocate 10% of their time. Newzoo highlights, that the global games market has expanded from $70B in 2012 to $180B in 2021. Within the market the fastest growing segment is mobile gaming at a CAGR of 27% from $12B in 2012 to $106B in 2021.

Majority of gamers are usually young adults with a median age of 29 years old. According to the Entertainment Software Association, 64% of American adults played video games in 2020. Now when it comes to esports, the competition sparks an immense amount of passion and engagement from fans. Millions of fans will want to watch their favorite performers and are also more willing to consume and spend on content.

In this market, there is a high demand for content with an engaged and passionate user base. Over the years, content creation in the gaming industry has democratized with standardized game development and distribution platforms (Unity and Unreal) resulting in over 15 million game developers making content.

👨💻What are the Strategic Resources?

Product Portfolio:

The company’s main strategic resource is their proprietary, highly scalable software platform. The goal behind the platform is to align developer and gamers interest and ensure user monetization. The formula is simple. The more contests and time spent by gamers in a specific game the more revenue is generated for developers. Okay so now let us understand the platform in more detail. The platform provides three key features connected by the power of data science.

Gamer Competition Engine: The software development kits provide 200 features in a 15-megabyte package to allow for seamless updates that improve gameplay, engagement, and retention. Focusing on retention, the company has found an efficient way to match skill rating and timely match gamers as well. Simultaneously to ensure engagement, the company has embedded social features such as in-game chat and participation within leagues or with friends to build community strengths.

Live Operations: The system technologies allow for multivariate testing to enhance engagement and retention. Additionally, with the segment management tool the company can create cross-application personalization and player incentive optimization.

Developer Console: Dashboard allows for developers integrate quickly and check the performance of their games. The developers are also able to onboard with little obstacles and are ready to use their software development kits in about a day.

*The company utilizes algorithms and machine learning capabilities to connect all the features of the software platform. This includes anti-cheat, anti-fraud, player rating, matching and segmentation. To ensure the best experience for a gamer, the company has identified 65 different behavior sets that can be implemented. Additionally, the company collects 300 data points during each gameplay session to feed their algorithms for optimization.

Developing Resources:

As of 12/31/2020, the company has 58 patents in total with 39 patents granted. The company has been steadily increasing their R&D investment amounting to $23M in 2020, representing a 110% YoY increase. To put in perspective, the investment represents 10% of revenue generated during that fiscal year.

Customer Landscape + Partnerships:

The Skillz Flywheel is built by a developer and gamer community. To date the company has 9,000 registered game developers. Top developer is 42% of revenue. From the gamer community the company has 2.6 million active users. Between these communities they company hosts on average 5 million daily tournaments with 1.4 million paid entry daily tournaments.

In Q1 2021, Skillz announced partnership with Play Mechanix Partners which will bring the arcade franchise Big Buck Hunter exclusive to mobile on the Skillz platform. Play Mechanix Partners has sold around 46k arcade machines worldwide.

In Q2 2021, Skillz announced a partnership with the NFL to host a global game developer challenge that will develop an NFL-themed mobile game. The challenge has launched.

Business Model and Growth Strategies:

How does Skillz achieve a business model that aligns the interest of developers and gamers? The company monetizes through competition. Players pay an entry fee and Skillz recognizes a 14.6% cut out that fee as revenue. The remaining is divided between prizes, incentives, and game developer profit share. Now it is important to understand that the entry fee break-out that is reported is not all cash deposits. It is currently 11% cash deposit, 82% cash winnings that have not been withdrawn, and 7% end-user incentives.

The company generated the following financial performance:

2020A Gross Margin Value: $1.6B (80% YoY) | 2021A Q1: $567M (85% YoY)

2020A Revenue: $230M (92% YoY) | 2021A Revenue: $83.7M (92% YoY)

2020A Paying Monthly Average User: 0.3M (88% YoY) | 2021A PMAU: 0.47M (81% YoY)

2020A Average Revenue Per Paying Monthly Active User: $59 (-5% YoY) | 2021A ARPPMAU: $60 (7%)

2020A User Acquisition Marketing Investment: $136.7M (160% YoY) | 2021A UA Marketing Investment: $54.3M (101%)

2020 – 60% of Revenue | 2021A Q1: 64% of Revenue

Based on GAAP measure the company is not profitable. However, the company believes if they exclude the UA Marketing Investment and apply their business model, they will result in 30% Adjusted EBITDA Margins for 2020A and 28% Adjusted EBITDA Margin for 2021A Q1.

The company claims their Gross Margins are 95%

The company plans to continue accelerating growth through the following initiatives:

International Expansion: 10% of Revenue was generated from the international market, which is a 4x larger market than North America

Increase Engagement: Estimated average time spent on Skillz platform is 60 minutes per user. Tap into the desire for competition.

Monetization Models: 16% of MAUs enter paid contest. The other 84% will be monetized with virtual goods and low friction ads.

🧬Team DNA and Vision

Key Leaders:

Andrew Paradise, CEO and Co-Founder – Andrew is a serial entrepreneur with a strong track record. He sold a mobile self-checkout to a public company and built many other private companies as well. Now Andrew makes sure his entire team at Skillz is playing video games. Personally, he has locked in 3,363 games (170 hours) of Bubble Shooter himself. He understand the convergence of human behavior, mobile gaming, and esports.

Casey Chafkin, Chief Revenue Officer and Co-Founder – Casey was the VP of Business Development for AisleBuyer working with Andrew. His business experience and has propelled him to build a great business model at Skillz.

The executive teams experience ranges from e-sports, finance, film production, and private equity investments at top tier companies.

Team Composition: The company has instilled a healthy culture that is realistically mission driven. First and foremost, all employees must play games at least 35 times per week. Over the course of their history, the company has been recognized for great leadership and an innovative environment. On Glassdoor, 83% approve the leadership of the CEO, and 75% would recommend their friends to work at Skillz. Let us see what employees have to say about the company

Pros:

"Skillz is a fast- paced and exciting place to work"

"Better work life balance than most companies I have worked for"

Cons:

"Normal startup growing pains: Everyone is busy with many responsibilities and there are long hours"

"Mid-market location on market street is convenient to Bart and Muni but not a great neighborhood"

🤯Key Insights for Time Investors:

Mobile gaming is taking over and in 2020 accounts for 51% of total gaming revenue. Based on trends presented from Will Hershey of Roundhill Investments, more people are watch gaming and Esports than Netflix, HBO, Hulu, and ESPN combined.

Scale will matter in Mobile. It’s quite common that many mobile games need to spend significantly to acquire users through paid marketing channels. With scale the company can generate additional content to ensure engagement. Sophisticated player segmentation tools that allow for customization will be essential to maximize the lifetime value of gamers.

Now let’s look at an investor’s perspective on gaming. Blake Robbins, Partner at Ludlow Ventures, was interviewed in Invest Like the Best about investing in gaming and highlighted an interesting concept about a platform that would be the “Webflow for games look alike”. This would empower creators to design games without friction spawning some top hits. Additionally, you are now able to build multiple games a year and when you have one game that is successful you can funnel that growth to other games creating a sustainable game publishing platform. This is interesting as Skillz has accomplished something similar in nature.

💪Key Strategic Moats

Technology: Company collects 300 data points during each gameplay and has identified 65 different behavior sets to product an optimal customized experience for gamers.

Strong Network Effects: The economic model incentivizes developers to produce greater content which in effect attracts more gamers. This flywheel effect creates an expanding community.

Business Model: By aligning incentives between gamers and developers, the company avoids adding consuming ads that create friction between users. This translates in strong unit economics resulting in 95% margin and 25% profit (ex-user acquisition investments)

Brand: Trust and Fairness are the two descriptions associated with the Skillz Brand.

Team: The company is lead by two serial entrepreneurs who have created a positive mission driven culture and connected the entire 277-member team with the gaming products produced in the platform.

⚠️Key Critical Risks

Competition: The company states that they compete with “alternative monetization services for mobile game content”. Companies that are competitors and partners are Sony, Amazon, Facebook, Apple, Google, and Unity. Other competitors are Zynga and Gluu Mobile.

Revenue: Two games from Tether Studios and one from Big Run accounted for 79% of the revenue. In total games developed by each of these two studios generated 87% of the revenue.

Game Development: The company relies on third-party developers to develop the games on their platform. Successful commercial relationships with developers are essential to ensuring quality content.

Gamer Community Risk: 80% of total paid entry fees are prior cash winnings that have not been withdrawn. Currently $2.8 million of end-user deposits have not been withdrawn for 2020.

Distribution: Company relies on Apple App Store, for distribution. Fee structures or policy changes can create significant risk.

The company states that they are connecting the world through competition. They want to focus on trust and fairness for users which enable game developers to build great content. This sounds like a good start.

Their platform enables developers to learn, grow, and share success through analytics while allowing users to connect, and experience a frictionless community which allows for competition.

To ensure great content the company monitors metrics such as the player liquidity inside each game based on number of daily active users, the stability of each game based on crash rates, the user satisfaction based on app store ratings, and user issues based on support tickets. The company wants to provide fair competition, network exposure, and financial success.

On the flip side, Wolfpack research has highlighted that there are some huge risks to Skillz. They have stated that the company’s growth projections can not be sustained when majority of the revenue is generated by three games. They have also denounced the NFL partnership that the company highlighted during its SPAC merger.

Wolfpack research has also highlighted that in-app purchases have declined and they have spoken with the third-party developers of those games to confirm the contraction. Essentially, they are claiming a shark fin effect. The research firm also highlighted poor leadership performance questioning the “serial entrepreneur” label of the CEO and the quality of the work environment.

While these reports have certainly introduced a new perspective, top tier investors/institutions continue to add a vote of confidence for the company:

Cathie Wood – ARK Invest: +18M shares - $288M

Atlas Ventures - $372M

Wildcat Capital Management - $344M

Morgan Stanley Investment Management - $322M

The Vanguard Group - $309M

Now, the company addressed their concerns from the short reports during their earnings call and with the continued positive performance they are on track in building an ecosystem greater than mobile gaming, according to the CEO. He quoted "We started with mobile gaming, but we think about the world as digital competition, and this is about building out the future of digital competition."

Stay incurably curious!

-Igli G. Laçi

If you like the content please make sure to share this newsletter, share this post, follow me on Twitter, and/or subscribe (if you have not already)!

Additional resources and sources I used for all the Time Investors

America's Fastest-Growing Company Turned Video Games Into a $54 Million Cash Cow - Inc.

Skillz Can Pay The Bills With Its High Growth - Seeking Alpha

Skillz Costing Too Much To Acquire Customers - Seeking Alpha

SKLZ: It Takes Little Skill to See This SPACtacular Disaster Coming - WolfPack Research

Disclaimer: The companies mentioned in my newsletter are not investment advice. This is simply information researched to help you learn about industries and various public companies