⚡This is Equity Breakdown, where you will find short, no bullshit overviews of public companies! Join me in breaking down industries and companies that will become leaders embracing disruptive technologies and innovating change! Subscribe Now!

“Compound interest is the eighth wonder of the world.” - Albert Einstein

To all the Time Investors,

We can all agree that our world is evolving at an exponential pace due to technology. The transformation to a fully digitized society is inevitable and thus creating the foundation of an AI-centric world. This is a world where machines will be able to learn and act intelligently and revolutionize the exchanges of ideas, healthcare, commerce, and all aspects of human life. The AI revolution has just started and by 2030 it is expected to deliver more than $15 trillion to the world economy. What an opportunity for humanity, to embrace such a revolution that will surpass the economic value of the internet. Now as curiosity and excitement tango, a question brews: “What resources, companies, or individuals are necessary to fuel and propel the success of this AI-centric reality?” The answer: Fearless vision, a lot of money, a lot of talent, a lot of data, and the ability to “produce golden eggs”!

Time Investors, today we will break down the Softbank Vision Fund: the largest tech fund in the world, who is determined to be an agent of change to accelerate the AI revolution.

🔴Download Equity Breakdown Report

📖What is the SoftBank Vision Fund?

The inception of the Vision Fund begins with the samurai grit, discipline, vision, and fearlessness of Japanese billionaire, Masayoshi Son, founder and CEO of SoftBank Group. SoftBank Group is built on the spirit of the Kaientai, a company led by Japan’s renaissance man and samurai Sakamoto Ryōma. The Kaientai had a 100-year vision for the future of Japan, and they put everything on the line including sacrificing their lives to transform Japan into a modern and prosperous state. Fast forward 145 years later, from the day the seeds were planted in SoftBank Group, Masa embarked on his journey with a remarkable superpower to anticipate the future and build the capital systems to propel the reality of that future. Today SoftBank Group stands among giants as the world’s third most profitable company in the world delivering $45.8 billion in net profits. This success is shaped by a consistent vision built on the spirit of innovation, visionary leaders, a talented pool of human capital, and a successful track record in lucrative investments such as the Alibaba Group, Sprint/T-Mobile, Arm, Yahoo Japan, and many others.

Now, Masa is fundamentally convinced that an AI revolution is exponentially evolving and will consume every industry in the world. This ultimate thesis spawns the birth of the Vision Fund which amassed $100B in under 8 months by May of 2017. To put this in perspective the entire Global VC industry invested near $300B in 2020. Ultimately, to understand the feat of this achievement you must observe the Jedi powers of Masa and Rajeev Misra, CEO of SoftBank Vision Fund, which during the fundraising process for the Vision Fund 1 raised $45B in 45 minutes ($1B per minute) from Saudi Arabia’s Public Investment Fund. This was followed by a personal commitment of $30B from the SoftBank Group and then the world’s most profitable company Apple, Qualcomm, Foxcomm, Larry Ellison, and Muabadala (UAE) as the key Limited Partners to achieve the jaw-dropping target. The sheer size of the Vision Funds cannot be ignored, and thus competition will follow through. Large investors like Tiger Global, T. Rowe Price, China New Era Technology Fund, Sequoia, and many others will attempt to ride the wave of the “mega-funds”. SoftBank Vision Funds has tapped the power of financial markets and rattled the VC world. And as we all know when disruptors arrive you either must evolve and compete or end up losing out. The game has changed and SoftBank has redefined the technology investing ecosystem. Now let us break down some critical facts:

What is the Vision Fund Goal?

The goal of the Vision Funds are to accelerate the AI revolution, by $130 billion in the businesses and technologies that will help make it possible.

What regions and sectors has the Vision Fund invested in?

The Vision Fund has a strong unmatched global presence: Americas: 36% | EMEA: 18% | Asia: 46% (China 28%)

The Vision Fund is industry agnostic.

What is the market value of the total Vision Fund and where does it sit in the SoftBank Group family?

The SoftBank Group net asset value is $236B with the Vision Funds contributing about 25%. Masa expects the Vision Funds to be the largest contributor soon. Uniquely, unlike the Vision Fund 1, Vision Fund 2 is solely funded by the SoftBank Group.

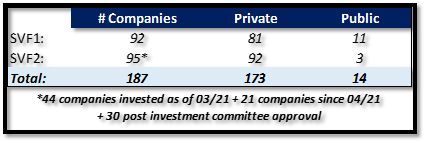

How large is the Vision Fund ecosystem?

The Vision Fund seems to be building the framework for the Berkshire Hathaway of the future!

What stage of investing does the Vision Fund focus and what is the average size of investment?

The Vision Fund focuses on late stage investing when the company has established itself to be a potential market leader.

The average investment amount for the Vision Fund 1 was between $300M to $400M. For Vision Fund 2, the average investment amount is $190M.

What level of ownership do the Vision Funds require and what is the time duration of the fund?

The sizable investments allow the Vision Funds to achieve a ~20-40% stake of a company.

The fund does not take operational control of the companies they invest. The founder is in full control in running his/her business.

Vision Fund 1 has a focus between 12-14 years. The SVFs believe this decade will be transformative.

💪What competitive edge does the SoftBank Vision Fund have?

To sustain a long-term business, the founder must have a competitive edge in the market. To build a 300-year technological empire, you need an ecosystem that collects a basket of strategic resources to execute a consistent vision. The SoftBank Vision Fund stands as an outlier with its position in the global investment community. And the keyword here is GLOBAL. With so much dry powder in the investing realm, as an established entrepreneur looking to hit that next stage in hopes of an exit, there are extremely limited players with the cross-section of technology investing and financial skills. So, why would someone want SoftBank money?

Ecosystem: SoftBank has amassed a diverse global portfolio across a variety of sectors. The company has direct investments in Alibaba Group, ARM, T-Mobile, 187 Vision Fund companies, and 37 companies in their SoftBank Latin America Fund. All these companies are solving different problems in inefficient markets but possess one core vision: embracing the technological advancements of AI. Now the benefits from this ecosystem are limitless.

First, Masa and his leadership team execute a strategy called “gun-senryaku”, which means a flock of birds flying in formation. This strategy enforces the idea that collectively the companies can grow much faster. SoftBank has a dedicated 100+ team building the framework of their value creation division which will provide portfolio companies the ability to learn from each other. For example, you have Paytm in India that can benefit from the experience and resources of Alipay.

Second, Rajeev Misra, CEO, highlighted in the Milken Institute interview that a company in the Softbank ecosystem becomes a customer of another company in the portfolio. He shared that Automation Anywhere, which had no presence in Japan, expanded with 300 employees and instantly had access to SoftBank Mobile, which has 35 million customers, thousands of retail locations, and a large sales and administrative force. In addition, in this same spirit, Masa hosts dinners and events to ensure executives from each company build a family-like bond and trust between each other. Uber and Mapbox, an AI-powered navigation system, closed a deal to build a partnership. This is the definition of the power of the SoftBank family.

Global Scalability: When it comes to growth, SoftBank Vision Fund helps design global business strategies. With limited resources, companies are mainly focused on establishing a strong market position in their local markets. They need the infrastructure support, market intelligence, and cohesive relationships to navigate international markets such as China. The SoftBank Vision Fund leverages their global ecosystem to immediately help portfolio companies access market share in international markets.

Special Know-How knowledge: Softbank Vision Fund sets itself apart from others with its ability to converge its skillset in financial markets with technology investing. They have the level of expertise with the leadership of Rajeev Misra, to skillfully access debt capital, which is significantly cheaper than equity capital. This debt capital is then deployed to fuel growth initiatives and re-enforce scalability. For example, when Coupang needs to finance warehouses for the e-commerce platform, the Vision Fund team is well equipped with resources from ex-bankers and traders from Deutsche Bank and UBS.

Power of Data: The Finance function in the SoftBank Vision Fund, has raised the bar in the ecosystem. They understand the power of data and the key insights they can deliver to “business enablers” in the organization and across the portfolio companies. Within the team, the CFO, Navneet Govil, has pioneered a new AI intelligence web-based tool built from one of their portfolio companies called Automation Anywhere to transform Finance into a strategic asset. The FinSight platform is designed to collect and visualize critical data that delivers insights regarding the Fund and each individual portfolio company. This has empowered executive teams, investing teams, Limited Partners, and SoftBank to leverage a “knowledge platform” that delivers insights on public market analysis, liquidity controls, performance, sector analysis, and portfolio reviews. All the business enablers are empowered with the ability to understand data frameworks, isolate critical risks, and more importantly build a finance structure that leverages AI-based technology across all portfolio companies. Imagine having the ability to pick the next company and founder based on the data insights collected from the SoftBank Vision Fund ecosystem.

🧬What process does SoftBank Vision Fund team follow when constructing their portfolio and vetting their investment opportunities?

The SoftBank Vision Fund deploys a unique investment model when constructing their portfolio relative to its competitors in the space. This strategy would incorporate the combined top VC expertise skills of selecting entrepreneurs with the savvy financial and management skills of running a conglomerate like Berkshire Hathaway. Going back to the competitive edges that the Vision Fund exhibits; Masa and the team want to build a cluster (flock of birds) of “No.1 AI strategy” companies. The core thesis is identifying companies that deploy artificial intelligence and machine learning to optimize every industry that affects our lives – healthcare, real estate, food, transportation, and many others. Masa and Rajeev seek to build a diverse portfolio of market leaders. So now let us look behind the curtain and understand the criteria framework the investment teams deploy when selecting the next family members of the Vision Funds.

The Selection Process:

The firm evaluates investment opportunities from three angles.

They invest in businesses that use next-generation technology platforms leveraging data and AI that can rapidly scale and have a clear path to profitability.

They target massive global markets where there is an opportunity for a new leader to emerge.

They also look for ambitious founders with a clear vision and a deep understanding of their customers.

When a company meets these three key thresholds, each founder will then meet with Masa in a personal meeting. To test the ambitions of the founder, Masa focuses his interactions on one central question, “What would [you] do if money were no object?”

Now, this selection process is constantly evolving and as the ecosystem becomes larger, the Vision Fund will have the ability to leverage AI technology to truly deliver data-driven insights. A key highlight is the FinSight tool pioneered by the CFO, Navneet Govil. As more data is collected in this knowledge platform, the value of insights highlighting the success and failures of portfolio companies will exponentially increase. Investment teams will be equipped to instantly contribute, influence, and impact a data-driven selection process for future investment opportunities.

📈What performance has the SoftBank Vision Fund delivered?

The Vision Funds collectively delivered strong results with a series of successful exits. As of the full fiscal year in 2020, the Funds produced ~$62B of gains and distributed to investors ~$22B, netting ~$40B in realized and unrealized gains. The gains this year were mainly driven by one of SoftBank Vision Fund’s favorite children:

Coupang: South Korea’s E-commerce Company: $28B in gains | (10.3x return as of 03/2021)

Some additional exists in the public markets for Vision Fund 1 are Doordash, (~$8.3B), Guardant (~$2.9B), Auto1 Group (~$2.3B), Opendoor (~1.6B), and Uber (~$12.1B return)

For Vision Fund 2, Beike, a Chinese Proptech Company, delivered $6B in gains.

Additional success can also be seen in the private markets with additional rounds raised for some key players who on average exceeded their previous valuations by more than 2x.

Cruise ($25.8B), GoPuff ($7.8B), Tessera ($550M), Whoop ($1.1B), Cameo ($900M), Ordermark ($280M)

I would like to also emphasize that a good portion of the gains are still unrealized. The Vision Fund has realized about 15% of the cumulative gains. This simply enforces the fact that the Vision Fund is a long-term fund that will capitalize on the returns during this decade.

Now it is important to note that some hurdles were also experienced. In 2019, the Vision Funds recorded heavy losses amounting to ~$17B driven by WeWork and Uber. However, with a persistent vision and some calculated “lucky investments”, the Vision Funds have come out with some home runs delivering staggering profits.

Overall, Vision Fund 1 has delivered 7% (fixed percentage) preferred equity IRR, 30% equity IRR, and blended 22% IRR for partners. From the SoftBank Group perspective, the Vision Fund 1 delivered a net equity of 39% IRR. Between the two funds, the investments have delivered a ~43% net equity IRR. This performance is expected to continue, as SoftBank Vision Fund 2 has already exceeded the number of companies from the Vision Fund 1. The management team and Masa continue to put their capital behind their vision with a strong level of confidence that AI-based companies in the private markets will outperform with lucrative exists on the horizon.

🤯Future of the Vision Funds

The SoftBank Vision Funds goal can be summarized into one movement: The AI Revolution. Masa and Rajeev continue to emphasize that their Alpha is the ecosystem that is constantly being built and evolving. The 224 companies across the portfolio will produce substantial financial and social impact to humanity.

As a start-up, growth investment firm, the Vision Fund is now entering a chapter of building a sustainable system that can achieve recurring gains, or as Masa puts it “produce golden eggs”. The systematic approach is necessary to ensure consistency across the discovery process, and more importantly the financing process which is a strategic resource of SoftBank.

Vision Fund 1 is now in the value creation phase. Alongside the operational and financial support, the firm is giving its companies, they also continue to monetize select investments with the goal of maximizing IRR and distributions to LPs.

Last year 26% of the Vision Fund 1 portfolio – based on fair value – was comprised of exited and public investments. Now that figure is 58%, which provides remarkable valuation transparency into the fund.

There is a significant number of private Fund 1 companies that are yet to be monetized. When they are, it will extend the fund's track record of distributions to investors.

In the next journey of the Vision Fund 2, SoftBank Group is the sole beneficiary with the initial $30 billion capital. An obvious observation is that an emphasis has been placed on healthcare with massive disruptive opportunities. With the pandemic and advancements in DNA sequencing driven by AI, SoftBank Vision Fund has executed 29 investments in US-based healthcare companies with a staggering average valuation of $1 billion each. However, the Fund will continue to be dynamic in their capital allocations across diverse sectors.

The formula is clear: Identify Companies utilizing AI + Be Fearless + Deploy Strong Financial Market Skills + Build and Leverage an Ecosystem = Golden Eggs

With strong public markets, SoftBank Vision Fund should expect a stream of exits through IPOs and M&As. Large deals will continue to develop, and the Vision Fund is at the forefront of that transformation.

In the latest earnings presentation, Masa shared a photo and a message that highlighted the origin of the SoftBank Group and its future.

“Back in 1981, at the year that we founded SoftBank in Fukuoka,” Masa stated, “at an exceedingly small town called Zasshonokuma. The most important thing is summarized here is on this one photo. Over the rail crossing, there is a huge dream. Grab that dream, no matter what it takes. And so long as I have this passion, excitement, and heartbeat, I will keep chasing my dream over the rail cross: Information Revolution – Happiness for Everyone.”

Time Investors, now that is a clear vision, which is one with the Force. When you dream, you dream big because “life is too short to think small.”

There are 1,000 unicorns around the world focusing on AI, and each represents an opportunity to realize the SoftBank Vision Fund’s dream.

Stay incurably curious!

-Igli G. Laçi

If you like the content please make sure to share this newsletter, share this post, follow me on Twitter, and/or subscribe (if you have not already)!

Sponsors: These companies help make the newsletter possible, make sure to check them out!

Commonstock: Join me in one of the most authentic social investing communities in the space. You will be part of a community that creates an environment of learning and transparency about all things finance and investing.

Masterworks: What’s the one thing in every hedge fund titan’s portfolio that you’re probably not investing in?

A-R-T. In fact, 84% of ultra-high-net-worth individuals collect art according to a 2019 Deloitte survey. It makes sense—contemporary art prices rose 14% per year from 1995-2020 vs. 9.5% returns for the S&P 500 (with virtually no correlation). And with the total art market expected to balloon from $1.7T to $2.6T by 2026, it’s no wonder that the price of paintings has steadily risen. One New York startup is at the center of it all: Masterworks.

They’ve fractionalized multimillion-dollar masterpieces by KAWS, Basquiat, Banksy, and more—and you can be a part of it. If you're looking for an elite, real asset class, check out Masterworks today. They’ve allowed Equity Breakdown subscribers to skip their 25,000 person waitlist with this link.*

Additional resources and sources I used for all the Time Investors

Disclaimer: The companies mentioned in my newsletter are not investment advice. This is simply information researched to help you learn about industries and various public companies