To all the Equity Contrarians,

As our economic infrastructure transforms incorporating technologies like wind turbines, electric vehicles, drones, or any advanced motion technology, certain rare minerals become strategic assets to maintain a competitive advantage in the near future. A key component for these technologies to function is through the use of magnets derived from rare earth minerals. However, rare earth minerals are hard to get to and dispersed in specific locations on the planet, with a high concentration in China. Now there is a company that aims to balance the scale of power and ensure the U.S. regains its title in the production of rare earth minerals and more importantly the magnets that will fuel the 21st-century technology applications. Today we will breakdown Mountain Pass Materials (MP).

Business Summary:

MP Materials owns and operates the largest, rare earth materials mining and processing facility in the Western Hemisphere.

The Mountain Pass facility has been around since 1952 and represents the only developed commercial source of rare earth materials in the Western hemisphere. It contains an open-pit mine and infrastructure associated with crushing, mining, flotation, and separation is available and in the process of being reactivated. The mine contains the following rare earths in its ore body.

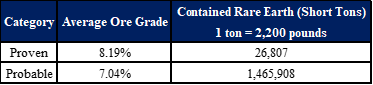

It is estimated that Mountain Pass has the following reserves and average ore grade which defines the amount and difficulty of mining the rare earth materials. The ore body is world-class with significant opportunities to extract valuable rare earth minerals. Based on the reserves without exploratory drilling, the expected life of the mine is 24 years.

All of the assets were acquired out of bankruptcy in 2017 by MP Materials. The company now has raised $545 million to execute a multi-phase plan to achieve the domestic supply of rare earth materials and production of permanent magnets. Below are the three stages that will secure profitability:

Stage I: Rare Earth concentrate production

Stage II: Separated rare earth oxide production

Stage III: NdPr Magnet Production

The company’s mission is “to restore the full rare earth supply chain to the United States of America”.

Industry:

Rare Earths are a family of 17 elements. The “rarity” of the minerals does not come from the limited supply but from the fact that they are hard to get at, difficult to separate/extract, and dispersed across the planet. The value in the minerals is derived from the creation of the first rare earth magnet in the 1960s. These magnets became key components that are essential to modern century applications in transportation, national defense, consumer electronics, and clean energy. The permanent magnets of today are composed of iron, boron, neodymium, and dysprosium (key ingredient for magnets to operate in high temperatures). As mentioned, rare earths are concentrated, and China controls the production of 98% of the world’s dysprosium and 83% of the global rare earth oxide production.

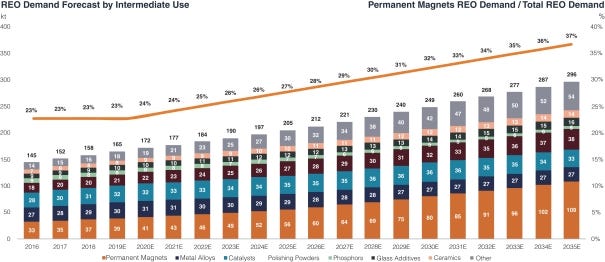

The Rare Earth minerals are part of a global market that is worth $3.4 billion annually, or 165,000 metric tons. It is growing at a rate of 3.7% and are used specifically in the following applications:

Clean-Energy Technologies: traction motors in EVs and generators in wind turbines, linear motors in mag-lev trains

Hi-tech applications: miniaturization of smart phones, computing devices, fiber optics, lasers, robotics, and medical devices

Defense applications: drones, control systems, radar, and sonar, communications

Industrial applications: catalyst application in oil refineries, pollution control systems in combustion engines, LED lighting and phosphors

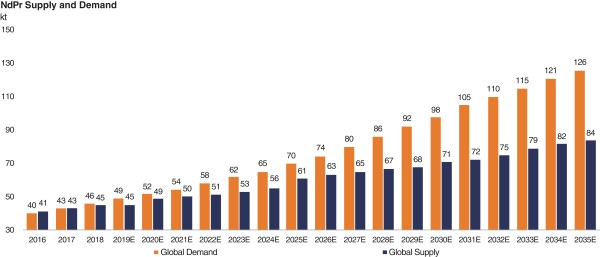

The Neodymium and Praseodymium (NdPr) magnets make up a significant majority of the market and are expected to grow to 6.1% CAGR from 2020 to 2035. The largest drivers will be the electrification of the transportation industry from EVs, trains, etc. Additionally, clean energy technologies and robotic industry will also be a key contributor to the market expansion of rare earth demand.

Market Opportunity:

As economies transform, the rare earth minerals will supply the electrification transformation to fuel that transformation.

The company will focus its efforts on the eventual production of NdPr magnets. As it stands today the magnets are a critical component and widely accepted as a standard in the EV industry. This results in a TAM of $10.7B by 2030.

Annual production of EVs is expected to grow to 57 million units by 2035. Each EV will require the NdPr magnet, which ultimately means high demand

The EV industry will consume 100% of the NdPr magnet demand with current production today

Business Model Landscape:

MP Materials currently produces rare earth concentrate that they sell to Shenghe Resources (Singapore). The company has successfully achieved Stage I where they can mine and produce rare earth concentrates. The business model will eventually expand to deliver the final production of NdPr Magnets.

The following customer landscape is currently present for MP Materials:

Shenghe Resources (Singapore) is the only customer the company currently sells to. The Singaporean company in turn sells the rare earth concentrate to end customers in China. The contract established is a “take or pay basis” which means the company will pay for the product even if they can’t take the delivery

The company advanced $50 million to help restart operations in Mountain Pass

Shenghe Resources will receive all the production of rare earths until the investment resources are recovered

Secure Natural Resources LLC (“SNR”), a company controlled by MP Materials majority equity holder holds the mineral rights to Mountain Pass mine as well

Competitive Strengths (Moats):

MP Materials has identified a series of strengths.

Location: Mountain Pass is the only scaled source for critical rare earths in operation in the Western Hemisphere. There is a high barrier of entry due to the financial burden and expertise of operating the mine making it very difficult to replicate.

Platform: The company is positioned to deliver rare earth supply, at a low-cost, domestic, and environmentally sustainable way. MP Materials has government support through the National Defense and Authorization Act of 2019 which has deemed NdPr magnets as critical to the defense and industrial security of the country. On Sept. 30, President Donald Trump signed Executive Order 13817, which seeks to return rare earth production to the United States and break China’s supply chain dominance.

Resource: With 60 years of operation the company owns one of the world’s largest and highest-grade rare-earth deposit

Sustainability: 95% of the water used is recycled and the facility uses natural gas to power its cogeneration facility that in return uses steam to provide power to the entire facility. The facility demonstrates superiority in terms of environmental impact.

Operating Strategy: Mountain Pass has re-established stable, scaled production of rare earth concentrate. The company has accumulated additional capital resources through its merger with FVAC to eventually build down-stream operations to separate rare earth minerals at lower costs to ultimately produce higher-value NdPr.

Competition/Risks:

The company has highlighted certain competitive and operational risks that may affect its performance.

Competition: The main competitors in the rare earth mining and processing markets are six major rare earth producers in China. Lynas is another smaller competitor that operates in Malaysia. Chinese producers historically have benefited from producing at low costs due to domestic regulations and low environmental regulations.

Environmental Regulation: Regulations relating to emissions, water usage, wastewater and stormwater discharges, air quality standards, GHG emissions, waste management, plant and wildlife protection, and disposal of hazardous and radioactive substances can severely impact operations. Permits will be based on ensuring the company keeps up with government regulations in the areas listed previously.

Depend on Shenghe Resources (Singapore) to purchase all the rare earth concentrate: All sales are conducted from the contractual agreement with Shenghe Resources. A breach of an agreement can seize current revenue risking Stage II and III operations for MP Materials.

Changes in China’s political environment and policies: Chinese government exercises control in nearly all sectors. Changes in laws and regulations can reduce shipments of rare earth concentrates impacting current revenue.

An increase in the global supply of rare earth products: China accounts for approximately 83% of the global production for rare earths and dominates the manufacture of NdPr magnets. The Chinese government is experiencing significant restructuring and consolidation and will potentially implement aggressive pricing measures and flood the market with NdFeb magnets to inhibit US production.

Team:

The company’s leadership team are high performing capital allocators specialized in scaling businesses.

James Litinsky, Co-Chairman, CEO: James is also the CEO and CIO of JHL Capital Group, an alternative investment management firm. He was also part of the investment group at Fortress Investment Group. He holds a J.D./MBA from Northwestern.

Michael Rosenthal, Chief Operating Officer: Michael has managed Mountain Pass since the company acquired the site in 2017. He was a partner at QVT Financial, an investment management firm. He focused his investment in the automotive sector and China.

Ryan Corbett, Chief Financial Officer: Ryan was Managing Director at JHL Capital Group LLC. He has a strong career in investment banking and corporate finance.

Current Ownership of >5%

JHL Capital Group (26.7%)

Shenghe Resources Holding (7.7%) – only customer for MP Materials

Fortress Acquisition Sponsor (6.4%)

James Litinsky (37.0%)

Daniel Gold (12.8%)

Financial Performance:

The company's recent closing share price is $22.29 resulting in a market cap of ~$3.5 billion and an enterprise value of ~$3.1 billion.

The company has achieved $73.4 million in revenue for year 2019, an 8.9% YoY over the $67.0 million earned in 2018. More recently the company in Q3 reported $41.0 million resulting in $92.1 million as of 09/30. This represents a 52% YoY in Q3 and 76% YoY YTD in 2020. A substantial majority of the sales are generated by the sale of concentrate to Shenghe Resources (Singapore).

As of 12/31/2019, and 2018, the company experienced net losses of $6 million and $13.4 million. However, the company has reported a positive Adjusted EBITDA of $1.9 million in 2019 and $24.6 million YTD in 2020 mainly driven by a strong Q3 of $11.6 million (159% YoY).

Originally the Mountain Pass facility had $1.7 billion of capital investments before it went bankrupt from their previous owner. With the completed merger with FVAC, MP Materials is now armed with $512 million in cash to continue their efforts to create the only scaled, fully integrated Western Hemisphere supply of rare earth magnetics with profitable operations.

MP Materials plans to continue growth through the following strategies:

Recommission the largest, most efficient integrated REO processing facility

Stage II completion will allow the company to leverage low-cost position to maximize earnings power

Build a marketing and sales organization to develop relationships with the largest American consumers of rare earth materials

Long-term vertical integration process REO into rare earth metals, alloys, and finished magnets.

-Igli

You can access and download the detailed report which will include the summary and a company info-graphic for your records.

If you like the content please make sure to share this newsletter, share this post, or subscribe (if you have not already)!

Additional resources for all the Equity Contrarians (Leeeetttsss Gooooooo!!!)

MP Materials One Page Infographic

MP Materials Company Filings

MP Materials Chamath Palihapitiya One Page Analysis

MP Materials MP Materials CEO Interview

MP Materials National Defense Magazine Article

MP Materials Reuters Article

MP Materials Company Video