There is a renaissance brewing and the goal is to target your mind!

To all the equity contrarians,

It’s time for a breakdown!

Mental health is a crisis that will continue to create social and economic burdens in society. Over 300+ million people suffer from major depressive disorders. But recently, the American people have spoken and a record amount of voters have come out to express their views regarding mental health. This week, Oregon voters have successfully passed an initiative, Measure 109 or commonly known as Psilocybin Services Act, to legalize “psilocybin mushroom therapy”. People want an innovative and responsible way to tackle this crisis, and it seems “magic mushrooms” might just be the solution. Today we will breakdown Compass Pathways (CMPS), a company with the mission to use psychedelics to transform mental healthcare.

Business Summary:

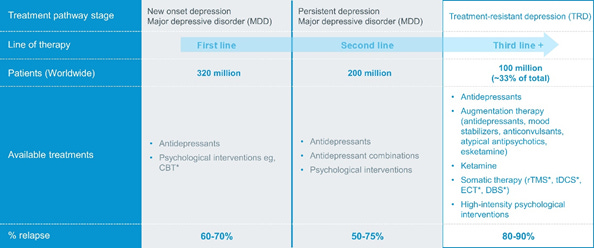

Compass Pathway is a biotechnology company that focuses on tackling the mental health crisis through the development of psilocybin therapy and psychological support resources. The company focuses on “treatment-resistant depression” which currently can’t be treated effectively by traditional medicine.

What is Psilocybin? – It is a naturally occurring chemical compound harvested from certain species of hallucinogenic mushrooms. These mushrooms are more commonly known as “Magic Mushrooms”. Usually, the hallucinations are visual and auditory. Early research highlights that psilocybin therapy has significant positive outcomes for people who suffer from depressions. One properly administered dose can create a significant drop in depression symptoms and last for six months.

The company’s primary asset is in a product that was developed named, COMP360. It contains the following features:

The product is a proprietary, high-purity polymorphic crystalline formulation of psilocybin

Optimal dosage is currently under study (1mg, 10mg, 25mg)

The company has developed a Psilocybin Therapy Protocol focused on three stages:

Preparation: An online platform has been created to educate the patients on what to expect from the experience and how to prepare for it. This creates an environment for therapists and patients to communicate.

Psilocybin Administration Session: The session lasts between 6 – 8 hours with a therapist and assistant therapist present. The therapist minimizes any anxiety and ensures psychological stability. Their goal is to allow the patient to be open without fear to the experience. The room is ambient, calm, and comfortable with a curated music playlist.

Post-Administration Integration: After the session, the therapist conducts a series of sessions that allow the patient to process the experience. The ideas and reflection will help the patient come to certain behavioral changes.

Training Protocol: It is important to note that the company has created an effective training program with input from psychologists, psychiatrists, and psychedelic experts. All therapists must be registered as mental health professionals with experience in counseling or psychotherapy.

The company’s mission is to, “create a world of mental wellbeing.”

Industry:

Globally, the World Health Organization estimates that more than 320 million people suffer from a major depressive disorder. Treatment for these symptoms relies on antidepressants and psychological interventions. 100 million are resistant to the current treatments resulting in 800,000 suicide deaths per year. To date, there are only two approved pharmacotherapies in the U.S.: esketamine and a combination of olanzapine and fluoxetine. This has created an industry plagued with underserved patients suffering from depression which ultimately creates a social and economical burden. The industry requires a combination of technology developments to access therapy and new synthetic compounds that go beyond just treating symptoms.

Market Opportunity:

In the U.S., an estimated $200 billion is spent a year on psychiatric conditions. 47% of the cost is directly from the healthcare system and the rest of the cost can be associated with loss of productivity and more severe life. The economic burden rose by 21.5% annually with an estimated $37 billion. Compass has an opportunity to impact 100 million+ lives. Additionally, Johnson and Johnson’s current nasal treatment approved by the FDA, using esketamine, is projected by analyst from Jeffries to generate $3 billion in sales with a price of $4,720 - $6,785. Compass is positioned to offer significant health benefits from a naturally occurring substance and effectively treat a large group of individuals who suffer from mental health.

Business Model Landscape:

The company currently does not generate any revenue and does not expect to generate any revenue from COMP360.

Commercialization Strategy: Upon approval from the FDA, the company will target healthcare providers and clinic networks in the U.S. and Europe. Compass Pathways will offer additional services such as therapist training, an education platform for healthcare providers, implementation services for treatment services, and material support to ensure quality.

A significant amount of investment has been placed in conducting clinical trials and establishing a portfolio of intellectual properties.

Phase I clinical trial: The trial included 89 healthy volunteers with an average of 36 years across both genders. This was the largest controlled psilocybin trial administered with individual support from therapists at King’s College in London. COMP360 was administered simultaneously to six people in the clinic and resulted in no negative trends in cognition or emotional responses.

Phase II clinical trial: The trial will administer active doses of COMP360 (10mg or 25mg) to patients suffering from treatment-resistant depressions. The company has 20 trial sites in nine countries in North American and Europe. This trial will include 216 patients and will focus on identifying the optimal dosage and confirm efficacy and safety. Data will be released in 2021.

Competitive Strengths (Moats):

The company believes everyone has a story and wants to tackle the mental health crisis in the most effective way. According to the SEC filings, Compass Pathway has the following advantages:

Proprietary Psilocybin Compound: In 2018, the company received a Breakthrough Therapy designation from the FDA for COMP360 for treatment. The company has been granted a patent in the U.S., Germany, and UK.

Therapist Training and Protocol: FDA approved request for 1:1 model of visual therapist support during the drug administration process. This protocol is necessary to ensure safety and efficacy of the psilocybin compound. Additionally, the company has created program that to date has trained 65 therapists. Scale will be achieved across academic institutions to ensure accredited training programs for psilocybin therapists.

Digital Technology Platform: The company wants to ensure access to the therapy through digital tools that enable self-care, remote consultations, and remote data collection. Sharing knowledge is key and they want to provide value across the entire process from the initial patient preparation to the effectiveness of the treatment.

Team: The board of directors and investors all provide significant credibility to the firm. The board includes former EVP and Chief Strategic Officer of Otsuka (one of the largest pharmaceutical companies and leaders in the depression sector). It also includes Chief Medical Officer at Theil Capital and former executives/chairmen of large companies like Johnson and Johnson. The direct leadership team also has great experience as biotech entrepreneurs with medical and research backgrounds across pharmacology, psychology, and psychiatry.

Competition/Risks:

The company has highlighted certain competitive and operational risks that may affect its performance.

Competition: In the U.S. there are currently two approved therapies for treatment-resistant depression patients: Johnson and Johnson’s Spravato (Esketamine) and generic medication with olanzapine and fluoxetine hydrochloride. Additionally, Sage Therapeutics and Axsome Therapeutics are also utilizing these existing therapies.

Controlled substance laws and regulations: The company has been granted government approval to conduct the clinical trials but adverse public perception of psilocybin can severely harm the business. The government has yet to provide specific requirements and restrictions on the use of therapists in the process. Additionally, Psilocybin is still classified as a Schedule I drug with heavy oversight from the DEA.

Clinical drug development is risky, lengthy, and costly: The success of the clinical trials is essential to the success of the company. A lot of investment is required, and any failure will delay regulatory approval and commercialization.

Dependence on therapist: The company heavily relies on therapists to administer the drug to patients. As a result, training, resources, and regulatory requirements are still in the early phases.

Team:

The company is led by the original founder and is composed of a team specialized in pharmacology and mental health expertise:

George Goldsmith, CEO/Chair of Board/Co-Founder: George served as Chairman and CEO at Tapestry Networks which he co-founded. He has served as CEO of TomorrowLab@McKinsey and has a strong background in psychology and clinical psychology.

Lars Christian Wilde, President, Co-Founder, and former COO: Lars was the co-founder of Springlane, a leading European direct to consumer kitchen and BBQ brand, and co-founder of Atai Life Science AG.

Ekaterina Malievskaia, M.D. Co-Founder and Chief Innovation Officer: Ekaterina served as the Head of Research and Development and Chief Medical Officer.

Top shareholders for the company are Atai Life Sciences (29%), the co-founding team, and critical investors like Thiel Capital (Peter Thiel).

Financial Performance:

The company is trading at $38.71 resulting in a market cap of $1.35 billion. During its IPO debut, the company raised $146.6 million.

As mentioned previously the company does not generate any revenue. As a result, it is incurring losses due to the heavy investment in research and development.

The costs involving R&D are the following:

Development Costs: Expenses related to research organizations, and investigative sites to conduct clinical trials.

Manufacturing and scale-up expenses: Costs for laboratories and trial set up supplies and equipment

Personal Expenses: Salaries for the 60 employees, and expenses related to employee research and development activities.

Share-based compensation: Equity rewards granted to employees conducting research.

Compass Pathways plans to continue growth through the following strategies:

Development of Drug Discovery Center: The focus will be to optimize the development of psychedelic and related compounds targeting neurotransmitters. The company also has acquired an 8% stake in Delix Therapeutics which develops molecules that allow psychedelics to carry benefits without hallucinogenic effects.

Center of Excellence: The company wants to create a new mental health model and create a center with research and innovation labs. Compass is calling them the “clinics of the future” which will utilize data analytics to gather evidence and improve therapy models and digital technology solutions to improve patient experience and support healthcare providers. The first facility will be created in Washington D.C.

Phase III registrational program: The company is currently undergoing Phase II clinical trial preparations with patients suffering from treatment-resistant depression. Based on the data in 2021, the goal will be to expand to Phase III clinical trials

-Igli

You can access and download the detailed report here which will include the summary and a company info-graphic.

If you like the content please make sure to share this newsletter, share this post, or subscribe (if you have not already)!