WELCOME BACK TIME INVESTORS!

This is Equity Breakdown, where you will find short, no bullshit overviews of public companies! Join me in breaking down industries and companies that will become leaders embracing disruptive technologies and innovating change! Subscribe Now!

“The true currency of life is time…and we have all got a limited stock!” - Robert Harris

To all the Time Investors,

A resurgence in the electrification of the automobile industry to combat global climate change is exponentially erupting. This next decade will bring change across the entire EV value chain creating lucrative opportunities for investors and of course, for our society’s survival in the future. To ensure the EV revolution expands rapidly, the U.S. government will fuel the largest mobilization of public investment, infrastructure, and R&D across the industry. They will put action behind their words by revitilizign their own fleet of ~650,000 vehicles:

The EV industry, which currently accounts for only 1% of global car stock as of 2019, will create a domino effect across many companies in the value chain. As Time Investors, we will breakdown the framework of the EV industry. This will help us identify companies with strategic assets that will deliver decades of wins and support our climate initiatives.

💡What will you learn in the Equity Breakdown Report?

EV Brief History

Industry Breakdown

EV Value Chain

Strategic Resources

Winners

Challenges

Key Insights for Time Investors

🔴Download Equity Breakdown Report

📜Blast from the Past:

Electric cars first spawned during the mid-1800s, a half-century before the invention of the gasoline cars. They gained a wide adoption across cities for ease of operation, no gas emission, and producing little noise. By 1900, electric vehicles represented 38% of US automobiles (~38k). This movement attracted prominent figures like Ferdinand Porsche, founder of Porsche car company, who created the world’s first hybrid car, the electric P1, powered by gasoline and battery power. Similarly, Henry Ford and Thomas Edison worked on projects to produce an electric vehicle that could run 100 miles, which eventually was scrapped due to costs. While the benefits for electric vehicles were obvious, interests in electric cars eventually declined because of three forces: infrastructure, mass production, and battery technology.

Most homes lacked electricity, lead-acid batteries weighed 500-1,000 pounds with heavy maintenance requirements, and the demand for the mass-produced Model-T accelerated. The inventions were present during the turn of the century; unfortunately, the infrastructure for innovation to spearhead electric vehicles was not practical enough to reach mass scale.

Now in the 21st century, we have a different narrative in place. The infrastructure to spearhead innovation across the EV space is vibrant and on the precipice of exponentially revolutionizing urban life.

📈The Industry Makeup:

Electric cars currently represent 2.6% of global car sales and 1% of global stock, amounting to a stock of ~7.2 million vehicles. In November 2020, 400,000 EVs were sold, with expected sales of 500,000 in December setting record highs. During the pandemic crisis, gas-powered vehicles experienced a serious decline in sales while EVs accelerated by 33%. According to Ark Invests predictions, the industry is expected to grow to 40 million vehicle sales in 2025, resulting in an 82% CAGR, and more than 30% of the stock to be electric.

This trajectory is a result of a series of factors fueling the EV market.

1. Government policies requiring zero-emission mandates

2. Environmental pollution

3. Technological advancement in cell batteries which represents the largest cost component of EVs

4. Competitive cost structures that are comparable with gasoline cars

5. Evolving Infrastructure to support the increase in EV demand

Currently, the leader in terms of vehicle output and adoption rests in China as they currently maintain 38% of the market share followed by the collective European countries and then the U.S. Within each internal market, European countries have achieved 20-30% market share while China hit an 8.6% market share.

The top 5 global EV car manufactures are Tesla (16%), Volkswagen (7%), BYD (6%), BMW (5%), and SGMW (5%) making up ~40% of the global market share.

The market can be broken out between passengers’ cars, commercial vehicles, and two-three wheelers (common in India/China). The majority of the share will be focused on passenger cars and more specifically mid-priced cars.

🖇️EV Value Chain:

Now as an investor, it is important to understand the supply chain of the EVs to position opportunities that offer monopolistic environments resulting in higher margins and sustainable profits.

The value chain can be divided into four categories with varying levels of economic characteristics.

1. Upstream: Raw material mining

2. Manufacturing: Battery Cell Manufacturing, Battery Pack Assembling, EV manufacturing

3. Downstream: EV Services, and EV sales infrastructure

4. Recycling of batteries

Specifically, when it comes to the various cycles of production, investors need to isolate opportunities that offer high barriers to entry, competitive advantages, and the ability to scale with strong unit economics.

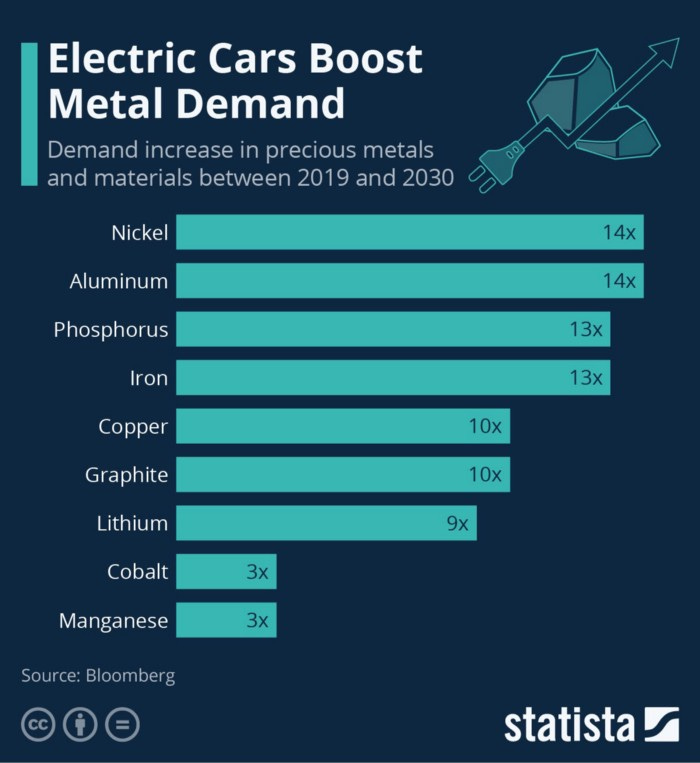

👨💻What are the strategic resources in the EV world?

Developing Resources:

1. Exclusive mining rights: Essential in the production of batteries which is one of the most expensive components of EVs. The raw materials are classified as rare earth elements with a high concentration in China, South America, Australia, and one world-class location in North America, specifically in the Mountain Pass deposit in California.

Mountain Pass Materials is developing the most advanced eco-friendly mining facility

High Barriers to Entry, Capital Intensive, Limited Supply

Research and Development:

1. Battery Technology: Batteries are one of the most important elements in EVs. The amount of energy that can be stored in a battery will determine the range and performance of the vehicle. The most common type of battery is Lithium-ion batteries making up about 70% of the rechargeable battery market.

There are three core components in making batteries: cell -> module -> packs

Cells: smallest, but most critical component that produces energy and make up 75% of the cost

China and the U.S. are expected to have 84% of the lithium-ion cell production

Module: contains several cells with terminals to connect and make up 11% of the cost

Packs: consist of modules that are assembled with cooling equipment and make up 14% of the cost

Ark’s research indicates that leaders are manufacturing cell-to-battery packs/vehicles without modules to produce more kilowatt-hours and increase the range of vehicles.

Battery costs have also improved drastically falling by 28% to below $100/kilowatt-hour (kWh)

Research is heavily focused in cathode materials that can deliver higher energy density

Tesla/Panasonic partnership leads the pack in battery production followed by LG Chemical, AESC, and Samsung SDI, QuantumScape

2. Semiconductors: The brain behind EV companies are chips. They enable the electrical sophistication of powering the batteries, supporting tech components in the vehicles, and providing software.

Nvidia, Taiwan Semiconductor Manufacturing Co, NXP Semiconductors, TE Connectivity, Infineon Technologies, Renesas

3. Autonomous Technology: EVs with the software capability to achieve self-driving autonomy will create an initial competitive advantage. There are assumptions that Tesla plans to launch a fully autonomous taxi network.

Camera-based strategy, Lidar and HD Mapping, and infrastructure sensors are three main technologies deployed to achieve autonomous driving

Ark’s research is forecasting $1trillion in earnings by 2030

Brand & Vertical Integration across the supply chain:

1. Distribution and scalability to increase market share will be defined by brand strength and infrastructure to produce rapidly. Vehicles with the most advanced technologies that achieve reliability, performance, and practicality will benefit. Additionally, many young EV companies are partnering with existing auto manufacturers who have the appropriate infrastructure to produce at scale, except for Tesla. Companies that develop their own production facilities with practical scalability will have an advantage initially.

2. High margin opportunities will also be present in the recycling process of batteries. Recycling batteries will require unique expertise in chemical management and logistical constraints in terms of the location of facilities.

🏆How to evaluate the winners?

1. Do not fall into the Nikola trap. EV companies with only a story will likely end-up last in this race. Companies that have proven tested prototypes with near sighted production plans have an opportunity. The most idealistic position will be EV companies that already have vehicles in the market and expanding their footprint.

2. Manufacturing infrastructure with high capacity. Very few EV companies can expand their footprint at the scale of traditional automakers. Usually, they must acquire and restore old plants or partner with legacy automakers who also are competitors in the market. It is important to identify players that can invest quickly in smart factories and scale rapidly without the significant support of existing large automakers. Profitable production at scale is key.

3. Unit economics plays a significant role, especially among commercial vehicles. It is important that the EV vehicles can compete in price with traditional gasoline-powered vehicles. The economic feasibility check will make it a no brainer for companies like Amazon, UPS, and other commercial fleets to make the switch towards EVs at scale.

4. Technology advancement and IP preservation will also become a critical factor. EV companies that have consistent R&D investments to generate future cash flows will have an advantage. Regarding the EV product, Ark highlights that $/charging rate or miles of range added per minute of charging will set companies apart from competitors. Beyond the vehicle itself, identify companies that will develop revenue streams from the collection of data, implementation of autonomous networks, and production of high margin products in the supply chain.

5. Teams with a high count of engineers and experts in the space will have a talent pool advantage. Look for EV companies with management that is experienced across the supply chain, leaders with expertise from legacy automobile companies, and existing talent from EV leaders such as Tesla.

6. Mass-Market demand needs to be available in the very near future. Identify companies that have high commitment and long-term relationships with customers. Usually, many EV companies that will become public will have very little revenue. As a result, relationships with large customers will make or break the company.

⛰️What challenges will the EV space experience?

1. Energy infrastructure to support the EV revolution. Consistent charging infrastructures at profitable business models are a necessity. Right now, there is a lack of consistency in supporting this infrastructure. User experience from payment platforms, uptime, performance, and ability to reserve a charger needs to be defined. Currently, user experience is not the best and one does not have the patience to wait for many minutes to drive an additional 20-40 miles. Charging should be as easy as filling up the car with gas.

2. Integration of Electric Vehicles with existing power systems: As EVs continue to expand, electricity demand and supply will need to adapt. Managing charging patterns as well as incorporating renewable-based electricity generation (such as solar panels) will play a key role.

3. Cybersecurity Risks: As vehicles become connected across all components and we shift to a stage of autonomous driving, cybersecurity becomes more important. Cars today have over 100+ electronic control units and millions of lines of code. Risks of hackers accessing ECUs can lead to severe public safety issues. Consumer trust can destroy a product or propel its adoption.

4. Recycling Infrastructure: Extraction of rare earth minerals like lithium is a difficult and lengthy process. Since a higher concentration of these metals already exists in batteries, recycling becomes a critical component. If EV companies are targeting a sustainable future, then a solution to recycle battery cells and other components in the supply chain is critical.

🧠Key Insights for Time Investors:

There is a major push from governments to reduce greenhouse gas emissions. The Biden administration has made it clear that they will support many changes that will transform the automobile industry

Understand the supply chain process and focus on the stages that will have less competition and higher margins. Raw Material Mining, EV brands that have advanced and protected technologies, and the recycling stage will present great opportunities

More specifically identify companies with the greatest engineering talent, heavily focused on R&D, have viable products, and realistic strategy to scale rapidly

There are four key segments in the space: passenger vehicles, light commercial vehicles, 2 Wheelers, Municipal Buses

As e-commerce is exploding and governments support policy the initial growth based on pure economics will be on “last-mile delivery” and buses.

-Igli

If you like the content please make sure to share this newsletter, share this post, or subscribe (if you have not already)!

The next couple of breakdowns will focus on the best companies that I believe will be strong players across the EV Supply Chain! Get ready Time Investors!

Additional resources and sources I used for all the Time Investors (Leeeetttsss Gooooooo!!!)

Disclaimer: The companies mentioned in my newsletter are not investment advice. This is simply information researched to help you learn about industries and various public companies.

Share this post