⚡This is Equity Breakdown, where you will find short, no bullshit overviews of public companies! Join me in breaking down industries and companies that will become leaders embracing disruptive technologies and innovating change! Subscribe Now!

“The true currency of life is time…and we have all got a limited stock!” - Robert Harris

To all the Time Investors,

Coinbase ($COIN) will go public today on the NASDAQ through a direct listing. The company that is propelling a decentralized infrastructure with decentralized assets will let the market decide its value. In their S-1 filing, the company listed some pre-IPO share sales which also gives us a peak in terms of the demand of interest. In Q3 of 2020, they sold shares weighted at an average of $28.83, and then in March of 2021 that price went up to a weighted average of $343.58. Now with trading activity today and an outstanding share balance of 261.3 million the company’s shares oscillated between $381 at the open, peaking at $429 and ending up with a closing price of $328 resulting in a valuation of $86B.

To put this in perspective, Coinbase could potentially surpass the value of Goldman Sachs, an institution that has been around for 151 years.

Now as a profitable company and an arsenal of increasing revenue and cash, Coinbase will not need to raise any money and thus the shares will come internally. Below is a snapshot from my previous write-up that highlights some heavy hitters in terms of share ownership:

Top Tier VCs: Andreesen Horowitz (15.8%) and Union Square Ventures (7.5%)

Top Investors: Marc Andreesen (15.8%) | Frederick Ernest Ehrsam (9.5%)

Brian Armstrong (CEO): (21.3%)

As a group the executive leaders and directors: (58%)

Coinbase is the first large player in the space that gives you the seamless ability to access and own the crypto assets that are molding a decentralized digital world. This success will ignite entrepreneurs and attract even more competition. Regardless of the price the company ends today, this is a milestone that will now bring focus into blockchain technology, crypto assets (i.e Bitcoin, Ethereum, Cardano), and the supporting infrastructure required to build out this market.

💪Coinbase Q1 KPIs

Post their S-1 filing the company posted their Q1 results this year indicating strong performance:

With the rise in the price of Bitcoin and other additional crypto assets, Coinbase is benefiting from a 30% increase in users resulting in strong financial performance.

The company highlighted three scenarios forecasting their transacting users in which it derives the majority of its revenue based on some key drivers.

Ultimately, Coinbase’s performance in the short term will be dependent on Bitcoin’s price and transacting volume. But on the flip side, the company is positioned to set the foundation for the “cryptoeconomy”.

📈The impact of Bitcoin

The global crypto market is at $2.91 trillion with Bitcoin representing ~38% at $1.1 trillion. The price of Bitcoin has now hit ~$62.8k. Fundamentally, from a supply and demand point of view, we know that supply is capped at 21 million Bitcoin. Now this leaves the demand component. At the point in time based on macro conditions such as suspected inflation and concept of digital scarcity, the demand for Bitcoin as an asset for wealth protection is certainly increasing.

In a three part research series Yassine Elmandjra, cryptocurrency analyst from ARK Invest, and David Puell, cryptocurrency on-chain analyst, highlight some key conclusions for bitcoin based on some fundamental metrics/trends:

To measure the health of the Bitcoin Network they focus three concepts: monetary integrity, security, and usage.

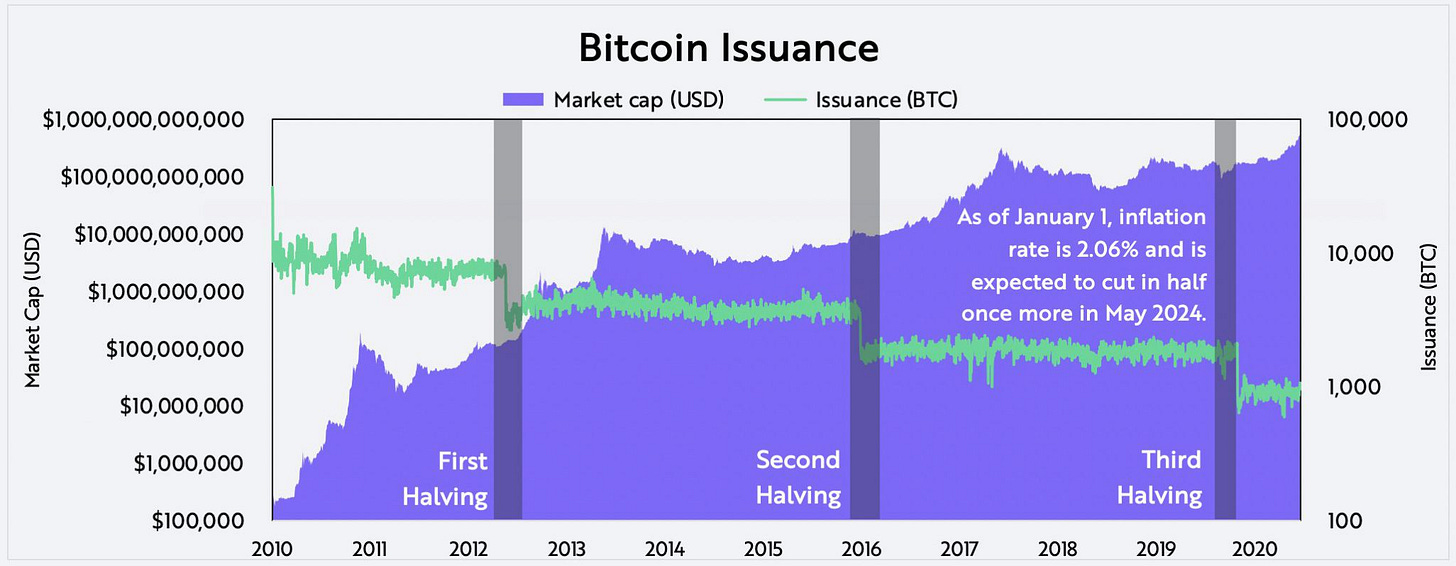

Monetary integrity provides investors at any point in time visibility in terms of the supply of Bitcoin. Using graph’s from glassnode, analytics platform, the circulating supply is ~18.6 million BTC. Additionally with each halving (three havings with the fourth one in 2024), the issuance of Bitcoin is cut in half. Ultimately, as the Bitcoin market cap increases supply is constrained.

Bitcoin’s security is also another critical component adding to value. The hash rate, reveals the processing power miners utilize to secure the Bitcoin network and as the market cap of Bitcoin has increased the hashrate as exponentially increased as well.

Usage is also the final component in the inital valuation of Bitcoin. It shows investors or users network activity, adoption, and economic activity. As of right now there are ~1 million active addresses. This number is highly dependent on the price of Bitcoin. Additionally, overtime the share of invidiuals holding less than 10 BTC has increased while those holding greater than 1,000 BTC has decreased.

From an economic activity perspective, BTC has an average of ~250-300k transactions daily with a total transaction volume of ~600M since inception. To give you a comparison point, Visa has 65k transactions per second.

From these three components one can highlight that Bitcoin has strong features that justify its digital scarcity and its role in the class of assets that represets a preservation of wealth. You can see why now, Bitcoin is the market leader in terms of crypto assets and why it plays such an important role for Coinbase.

🤯Key Insights for Time Investors:

Coinbase’s IPO is a critical milestone for the crypto world. The crypto market is at its infancy and Coinbase represents the stepping stone to a great market that is developing.

Based on their Q1 results, Coinbase is in a strong position financially and in terms of market share realizing the fact that 90% of their customers to date have been acquired for free (organically). They will leverage their brand equity and the services they provide to continue maintaing their position as a market leader.

As the company enters the public markets, competition from existing exchanges as well up-coming crypto players will create revenue pressure. Coinbase derives majority of revenues from transaction fees in their platform and is currently one of the highest in market at around ~0.5%. This will certainly challenge their top-line if Coinbase is slow to diversity its revenue streams.

The company at its current structure is also highly sensitive towards Bitcoin’s market volatility. Because of the appreciation in Bitcoin price, users have gravitated to Coinbase to gain an entry point. A potentail price adjustment can result in an opposite effect.

Security is also an additional risk. Potential hack and the loss of crypto assets will inevitably create a loss of brand equity.

Brian Armstrong, CEO of Coinbase quoted on CNBC today “We are the first Fintech that is vertically integrated. We start from the customer relationship and all the way down to integration with the underlying rails {financial system framework] themselves. As blockchains scale, we will build on the new rails and create a new type of company: a crypto company.” This will bring new waves of companies in the crypto economy that will ultimately spawn greater opportunities for investors.

Stay incurably curious!

-Igli G. Laçi

If you like the content please make sure to share this newsletter, share this post, follow me on Twitter, and/or subscribe (if you have not already)!

Additional resources and sources I used for all the Time Investors (Leeeetttsss Gooooooo!!!)

Disclaimer: The companies mentioned in my newsletter are not investment advice. This is simply information researched to help you learn about industries and various public companies