⚡This is Equity Breakdown, where you will find short, no bullshit overviews of public companies! Join me in breaking down industries and companies that will become leaders embracing disruptive technologies and innovating change! Subscribe Now!v

“The true currency of life is time…and we have all got a limited stock!” - Robert Harris

To all the Time Investors,

Today we are beginning our passage to understand the SPACE industry and as such, I think we can start off with the opening theme song from a childhood show…“Five, four, three, two, one…rangers in space. Set controls to outer space now.” Well, I’ll stop there before it’s too late.

When anything remote to Space comes up, I just enter another world out of excitement. There is so much to learn especially as the industry evolves from a niche defense government-sponsored sector to a thriving global economic industry fueled by new advanced technologies and private companies.

Space is now a central focus to many long-term investors. This is perfect as we begin our learning process this month by breaking down the new Space ETF ($ARKX) relative to some existing ones such as the Procure Space ETF (UFO) and the SPDR ETF (ROKT).

🔴Download Equity Breakdown Report

📖What is ARKX?

The ARK Space Exploration & Innovation Fund is created to give investors exposure to companies spearheading the use of reusable rockets, technologies in orbital and suborbital aerospace, aerial drones, 3D printing, and enabling technologies. The fund is composed of 38 individuals companies and ARK’s 3D printing ETF ($PRNT) as their second-largest holding.

📈Market Opportunity

Currently today, the space industry can be valued at ~$400 billion with projections to hit ~$1 trillion by 2040. Now the industry can be divided into three sectors: products & services, infrastructure, and government.

Products and Services: telecommunications, GPS, observation, sensing, & monitoring (weather tracking)

Infrastructure: Space vehicles (rockets, shuttles), ground & space stations, terminals, and receivers (satellites)

Government: geopolitical monitoring, defense (missile tracking), government agencies (NASA)

The space economy is prime to experience greater growth driven by sustained investment, technological advances, and the need for resource exploration and extraction. To really get an idea of the amount of interest from investors in the industry, Space Capital, an early-stage venture capital firm exclusively focused on space technologies, reported that since 2011 $177 billion of cumulative equity has been invested across 1,343 companies. The majority of these investments are coming from the U.S. (47%) and China (29%).

From ARK’s perspective, the space industry is divided between three core ideas: global connectivity, hypersonic travel, and multi-planetary space travel. Each of these big ideas focuses on technologies that can drastically transform economic expansion. Ark believes that in the near time connectivity and hypersonic travel will deliver great opportunities.

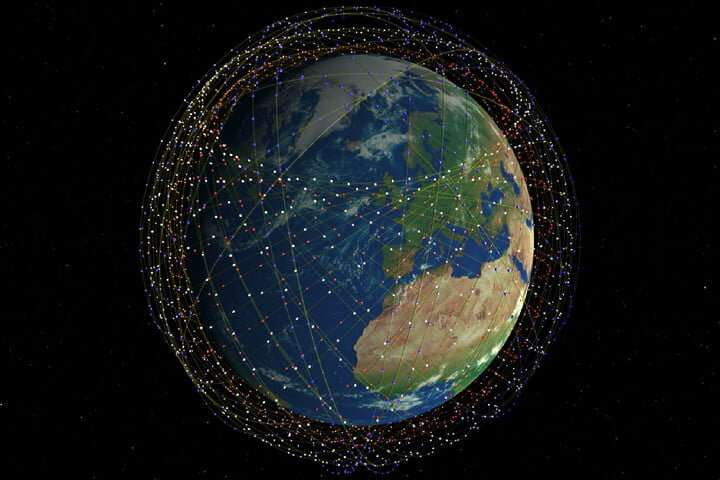

Currently, half of the world’s population (3.7 billion) do not have internet access. In the U.S., more than 19 million households have no internet connection and 157 million do not have access to broadband speed. To tackle this problem, more satellites are needed in the lower orbit of our plant. This can only be achieved by ensuring launch costs are economically feasible to meet the rate of demand. With reusable rockets, companies are taking advantage of the drastic drop in costs and are launching more frequently in low earth orbit.

As of 2020, there are ~2.6k active satellites in orbit and ARK estimates that in the next coming years ~25k actives satellites are planned to be in orbit. As more people are connected to the digital world, ARK estimates that in the next five years the market can be valued at $10 billion annually in the U.S. and $40 billion annually across the globe. If you also include the expansion to all devices of the internet of things and additional space services, ARK estimates $100 billion annually.

Simultaneously, global economic expansion requires efficient commercial travel. Hypersonic travel will be essential for point-to-point connections. This access will be economically appealing towards business travel and high net worth individuals. ARK estimates that ~2.7 million passengers will be willing to pay $100k to save 13 hours of international travel resulting in a $270 billion market annually.

🧬ETF DNA and Vision

ARK’s Space ETF has attracted over ~$542 million in inflow since its launch on March 30th. Based on an analysis from Seeking Alpha, the average ETF usually takes three years to achieve $100 million. This is astounding and truly reveals the brand equity that ARK has built with investors during these past two years. At the same time, ARK has also received some negative feedback from some of the positions that do not traditionally fall under the “space theme”. Now excluding the 3D Printing ETF selection in ARKX, the top 10 holdings are identified below:

Trimble Inc. ($TRMB) | Enterprise Value: $21.6B | Electronic Equipment Instruments and Components

The company started as a GPS company and now offers full technology solutions for positioning, modeling, connectivity, and data analytics across agriculture, geospatial, construction, civil engineering, forestry, and rail.

Kratos Defense & Security Solutions Inc. ($KTOS) | Enterprise Value: $3.5B | Aerospace and Defense

Defense company that delivers microwave electronic products, space, training and cybersecurity/ warfare, satellite communications, C5ISR/ modular systems, turbine technologies, and defense and rocket support services.

L3Harris Technologies Inc. ($LHX) | Enterprise Value: $49.3B | Aerospace and Defense

The company delivers mission-critical solutions ranging from pace payloads, sensors, and full-mission solutions; classified intelligence and cyber defense solutions; mission avionics; and electronic warfare systems. Satellites, defense satellite imaging, and weather satellite imaging are some initial functions.

JD.com Inc. ($JD) | Enterprise Value: $115.0B | Internet and Direct Marketing Retail

The e-commerce company out of China will need precise data for its customers as the channel grows. The quality of data, such as the location of people or their daily movements in their environment, will be heavily dependent on satellites.

Iridium Communications Inc. ($IRDM) | Enterprise Value: $7.0B | Diversified Telecommunication Services

The telecommunication company offers voice and data connectivity through a constellation of 66 crosslinked LEO satellites.

Lockheed Martin Corporation ($LMT) | Enterprise Value: $117.7B | Aerospace and Defense

The company is heavily involved in defense and national security space offering services and assets in aeronautics, missiles and fire control, mission systems, and space. The company has over 100 years of aerospace experience.

Komatsu Ltd. ($6301) | Enterprise Value: $37.2B | Machinery

A Japanese company that manufactures large construction, mining, forestry, and military vehicles/equipment. The use of satellite data will help guide autonomous equipment.

Thales S.A. ($HO) | Enterprise Value: $20.4B | Aerospace and Defense

Aerospace and defense conglomerate that offers communications, command, and control systems. They supply orbital infrastructure equipment to the International Space Station and are also in the business of building satellite constellations, and unmanned robots for space exploration.

NVIDIA Corporation ($NVDA) | Enterprise Value: $351.2B | Semiconductors and Semiconductor Equipment

The company operates in graphics, compute and networking, and rapidly expanding in AI. The company’s embedded GPUs can be applied to a multitude of space-based applications. Their computing platforms are famously known for their contributions to artificial intelligence and data mining.

The Boeing Company ($BA) | Enterprise Value: $188.4B | Aerospace and Defense

Boeing is also an incumbent defense conglomerate that builds airplanes, rockets, satellites, telecommunications equipment, and missiles worldwide. They are focused on deep space exploration as well as offering advanced space and communications systems for military, commercial and scientific uses.

From an industry breakdown, 66% of the mix is concentrated in Aerospace and Defense, Internet and Direct Marketing Retail, Electronic Equipment Instruments, and Semiconductors. Similarly, 75% of their portfolio is built by mega (>$100 billion) and large (>$10 billion) market cap companies in the industry. ARK is placing their calculated bets on industry leaders that have been involved in the space industry directly and that benefit from space technologies on Earth.

Cathie has emphasized when it comes to space it sometimes takes big companies to fuel big ideas. Interestingly some of these large and mega-cap companies are implementing a cohesive strategy that spans beyond rocket production and technology and also focuses on space communications and drone technology. With low costs in satellite technology, low-orbital space infrastructure can scale supporting a multitude of businesses on earth.

Now there are some unique picks here that at first glance do not connect directly with the space industry. Amazon, Google, and Netflix are three mega-cap companies that stick out. Amazon Web Services launched a new unit called Aerospace and satellite solutions. Projects such as the satellite connection service called AWS Ground Station, and the satellite internet venture called Project Kuiper reveals their interest in using space technologies to enhance connectivity. Google is also utilizing its computing power in the cloud and AI to support space projects regarding imaging and mapping. Now Netflix is a unique outlier. When you think of streaming you should also think of the high demand for broadband. Entertainment is one of the tops uses for broadband. More satellites in low orbit mean more efficient broadband and access to streaming services across populations that had no internet connectivity. Also as cars become autonomous and internet access available across the globe, Netflix will benefit.

Surprisingly, Virgin Galactic the first public pure-play space company did not make it on the top 10 list for ARK. The company is famously known for leading the charge on commercializing space tourism. In an interview, Cathie Wood mentioned that beyond internet connectivity, they view hypersonic travel as another additional opportunity. At the moment, Virgin Galactic has mentioned hypersonic travel but has not identified any specific long-term plans to operate in the space, thus making them holding #20 on the ARKX fund. With their space shuttles and assets, the company is well-positioned to make some breakthroughs if they can successfully accomplish their launch targets in the next couple of months.

On the other hand, there are 9 pure-play SPACs that have announced mergers this year specifically focused on space. Companies like Rocket Lab, Black Sky, and Momentus Space are all jumping in the action. When it comes to SPACs, ARK has decided to ignore all of the pure-plays with the exception of three SPACs that benefit indirectly from space technologies:

Workhorse Group ($WKHS) |

EV Company that produces last-mile delivery vehicles. They will need satellite technology to track their vehicles and optimize their performance.

Atlas Crest Investment ($ACIC)

The SPAC is merging with air taxi startup Archer Aviation in a $3.8 billion deal. The vehicles aim to be autonomous thus requiring an air data system, radar and laser altimeter, and other technologies supported by low orbit space infrastructure.

Jaws Spitfire Acquisition ($SPFR)

The SPAC is merging with 3D-printing company Velo3D, valued at $1.6 billion. Velo3D is known for producing components for space rockets, jet engines, fuel delivery systems, and energy production. SpaceX is one of their most recent clients.

A common theme one will notice across ARK’s space ETF is that they believe mobile connectivity, 3D printing, robotics, sensors, artificial intelligence, and rocket technologies will all converge together to deliver the $1 trillion market.

⚠️ETF Competition

When comparing other ETFs in the space nothing comes close to the AUM that ARKX has accumulated in the past week and a half. However, there are some formidable players that have some similarities to ARKX and some stark differences as well. The UFO Procure SPACE ETF is the first ETF that tracks the S-Network Space Index, which is concentrated on companies that have significant space-related activities. The fund is composed of 33 positions and has an AUM of $136 million. The top 10 positions for UFO are as follows:

Orbcomm Inc ($ORBC) | Enterprise Value: $1.1B | Diversified Telecommunication Services

Trimble Inc ($TRMB) | Enterprise Value: $21.6B | Electronic Equipment Instruments and Components

Garmin LTD ($GRMN) | Enterprise Value: $23.1B | Household Durables

Dish Network ($DISH) | Enterprise Value: $32.3B | Media

Eutelsat Communica ($ETL) | Enterprise Value: $5.6B | Media

Sirius XM Holdings ($SIRI) | Enterprise Value: $35.0B | Media

SES SA ($SESG) | Enterprise Value: $7.1B | Media

Iridium Communications Inc ($IRDM) | Enterprise Value: $7.0B | Diversified Telecommunication Services

Sky Perfect Jsat H ($9412) | Enterprise Value: $1.5B | Media

Weathernews Inc ($4825) | Enterprise Value: $464M | Professional Services

Based on the fund build, UFO has 82.8% of its market cap in Media, Aerospace and Defense, Diversified Telecommunications Services, and Communications Equipment. The fund is also more heavily concentrated in medium and large-cap companies ranging from $2B - $10B. Based on their top picks you can vividly see that the team is heavily placing their bets on satellite-based consumer products, satellite manufacturing, space technology hardware, and space-based imagery and intelligent services.

Another competitor would be ROKT SPDR S&P Kensho Final Frontiers ETF, which runs $24M in AUM and holds 30 positions. This fund also has some similarities to both ARKX and UFO but more concentrated in Aerospace and Defense with Maxar Technologies ($MAXR) and Aerojet Rocketdyne Holdings ($AJRD) as their top two holdings.

Between these three funds, there are some overlaps that highlight common strategies and confidence in terms of the companies role in the space industry. Trimble, L3Harris technologies, and Iridium are represented across all three funds. This signifies the importance of satellite technologies, GPS, and communication devices that are essential for industries on Earth.

🤯Key Insights for Time Investors:

It is important to understand that space investments are highly capital-intensive investments that will take years to see business models come to fruition. However, with that said companies like SpaceX and the allure of deep space travel have sparked the imagination of ordinary citizens and investors. Since 2011 $177 billion of cumulative equity has been invested across 1,343 companies. In Q4 2020, $5.7 billion was invested across 80 companies.

As an investor, the greatest reward within this decade will involve companies that operate in satellite technologies due to the dropping costs in rocket launches. Additionally, companies on earth that will benefit from greater connectivity will also be great investment avenues to research.

When it comes to space, ARK believes that technologies will converge supporting accelerating growth opportunities. Automation and artificial intelligence will play a significant in space-related activities that will impact industries on Earth such as the agricultural industry and construction industries.

In an article from Michael Sheetz, Space Reporter, he highlights a comment from CEO Chad Anderson that states, “Space is the vantage point that allows us to do business.” “It’s what links our financial markets, shipping lanes — the global economy as it exists today would not exist without space.” http://cnb.cx/2NyWvki

Stay incurably curious!

-Igli G. Laçi

If you like the content please make sure to share this newsletter, share this post, follow me on Twitter, and/or subscribe (if you have not already)!

Additional resources and sources I used for all the Time Investors (Leeeetttsss Gooooooo!!!)

Disclaimer: The companies mentioned in my newsletter are not investment advice. This is simply information researched to help you learn about industries and various public companies