To all the Equity Contrarians,

One of the most anticipated IPO’s of the year is finally happening. This would represent the third-largest IPO of the year after Snowflake’s snowstorm and Bill Ackman’s Goliath-like SPAC. Tonight we will breakdown Airbnb, (ABNB), a company that wants to revolutionize human connection through authenticity, community, and design.

Business Summary:

Airbnb is a technology company that fosters a marketplace for home-sharing at a global scale. The peer-to-peer exchange platform of homes and cultural experiences creates a natural marketplace for guests and hosts. The company claims that after 13 years with over 4 million hosts and 825 million guest arrivals, they have helped millions of people satisfy a strong human connection. The company has three core principles:

Community is based on connection and belonging

Creativity and design are at the center of strategy

Responsibility to all stakeholders that support the natural marketplace

The Airbnb ecosystem is made of up guest and hosts who experience the following features:

Guests: 54 million active bookers worldwide booked 327 million nights and experiences on the platform. They can experience unique spaces, visit real communities, be hosted with authenticity, and more importantly, rely on a trusted platform

Hosts: Hosts are represented globally, and benefit from the platform with earned income, connecting guests to their communities, and ultimately sharing skills and passions. 90% of the hosts were individual hosts, and 79% of those hosts had just a single listing. And as of December 31, 2019, 72% of the nights booked were with individual hosts.

Technology Platform: The platform is designed to drive organic attraction through ease of use and more importantly the ability to allow millions of strangers to trust one another. They system contains many components:

Reviews | Secure messaging | Risk scoring | Secure payments | Watchlist and background checks | Cleanliness | Fraud and Scam Prevention | Booking Restrictions | Guest Refund Policy |

Delivers deep business intelligence insights to manage the marketplace from pricing to occupancy optimization

The company’s mission is “to allow people to experience a deeper connection to the communities they visit and the people who live there. They want you to “travel like a human”.

Industry:

The travel industry is composed of many diverse facets ranging across lodging, transport, and attractions. According to the U.S. Travel Association in 2019, $1.1 trillion was spent by travelers amounting to $2.6 trillion in economic output and supporting 15.8 million jobs. To put this in perspective direct spending by residents and international travelers in the U.S. spent an average of $3.1 billion a day, $128.6 million an hour, $2.1 million a minute, and $35,700 a second. Globally, travel and tourism’s direct contribution to GDP was around ~$2.9 trillion with a significant portion contributed from the U.S. The World Travel and Tourism Council estimated that travel spend will grow at a 3.5% compounded annual growth rate from 2019 to 2030.

Traditionally, the travel industry has developed around standardized hotels and selected attractions. However, with the sudden economic impact of Covid and integration of technology, the industry is experiencing democratization at an accelerated pace brewing new trends.

Demand Evolution: Domestic and regional destinations are preferred during Covid times. This consumer behavior is creating abundant support for the local communities.

Health & Hygiene: 89% of Americans are more conscious of germs now than before. Many fears contracting the virus and as result cite cleanliness & health as a critical factor for traveling.

Innovation & Digitization: Remote work and will create new destinations for human migration. This will spur local community growth in terms of spending and digital infrastructure.

Authenticity: Travelers are seeking authentic experiences in their destinations. Leisure activities and housing will need to bring to life the cultural elements of destinations.

Market Opportunity:

The company believes its serviceable addressable market (SAM) is $1.5 trillion.

$1.2 trillion is for short-term stays (* short-term stays = fewer than 28 nights)

Long-term stays represented 14% of nights booked in 2019 and 24% for nine months ending 09/30. This however was excluded from the SAM estimate

The company accounts for 20% of the vacation rental industry

$239 billion represents experiences (spend of travelers on attractions, including spas but not casinos)

The total addressable market (TAM) is $3.4 trillion.

$1.8 trillion is for short-term stays, and $210 billion for long-term stays.

$1.4 trillion represents experiences (includes spend of local residents on recreational and cultural attractions such as sporting events, summer camps, etc.)

Business is global so the TAM can also be broken out in the following geographies:

$1.5 trillion in Asia Pacific region, $1.0 trillion in EMEA, $0.7 trillion in North America, and $0.2 trillion in Latin America

Business Model Landscape:

Airbnb has created a marketplace where hosts offer guests stays and experiences on their platform. The company produces revenue through service fees charged to hosts and guests net of incentives and refunds. They also collect lodging taxes that must be paid to the respective authorities. Below is an example of the revenue model:

The following customer landscape is created through Airbnb’s platform:

4 million hosts as of 09/30/2020

55% are women with 86% of hosts located outside the U.S.

7.4 million available listings of homes and experiences (5.6 million are active listings)

Listings (private rooms, entire rooms, luxury villas, treehouses, and experiences) are in 100,000 cities across 200+ countries

In 2019 the company had 54 million active bookers (booked stay or experience) and 247 million guest arrivals

84% of the revenue in 2019 came from guests stays with existing hosts who had completed at least on the check-in

69% of the revenue was generated by stays within the year in 2019 from repeated guests

63% of the revenue was generated by listings outside of the U.S. – global business

Competitive Strengths (Moats):

Airbnb has classified a series of core strengths that helped them revolutionize the travel industry.

Host Community: The hosts are unique and participate in the platform organically. Hosts recruit hosts and guests often become hosts. In 2019, 23% of new hosts were guests on the platform. The majority of the listings are available only on Airbnb

Guest Community: 69% of the revenue was driven by returning guests. They are actively involved in the community with 68% of them leaving reviews for their stay. Guests come to the platform directly, actively participate, and return regularly

Global Brand: “Airbnb” has evolved into a noun or verb when one wants to book an experience or travel. Google trends highlighted that Airbnb was searched worldwide more than any other travel brand. 91% of all traffic to the platform came from organic channels

Global Network: The ecosystem on the platform allows hosts and guests to attract each other. This frictionless interaction has created a global web that has broken boundaries and continues to attract new hosts which in turn attract new guests with new experiences

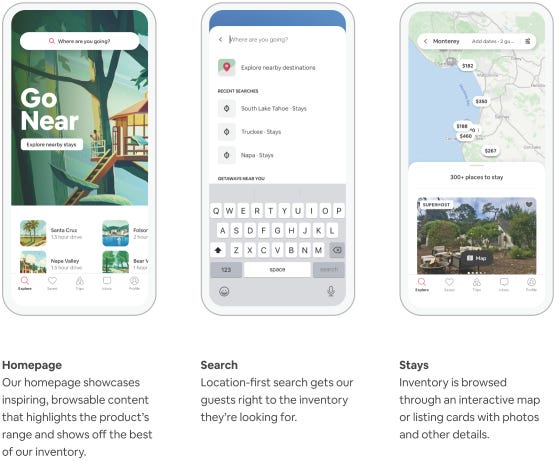

Platform with design focus: The platform offers unique needs to hosts and guests. Hosts get global demand, activation, merchandising, pricing recommendations, scheduling, integrated payments, community support, Superhost programs, reviews, and feedbacks. The process is fast, intuitive, and easy. Guests can explore unique homes and experiences through the web and app platform

Competition/Risks:

The company has highlighted certain competitive and operational risks that may affect its performance.

Competition: The company has many competitors across certain categories in the industry

Online travel agencies such as Booking Holdings | Hotel Chains such as Marriott | Chinese short-term rentals such as Tujia | Online platforms offering experiences such as Viator |

Covid/Adverse Effects on Travel Industry: With strict lockdowns to mitigate the spread of the virus, the travel industry experienced record losses. In the near term, this contributed to a decrease in bookings in the most infected regions. In addition, the company experienced a reduction in workforces and restructuring costs considering the economic situation resulting in $135-$150 million of charges in 2020

Regulations/Laws/Rules that limit short-term rental and home-sharing: Affordable housing and over-tourism are common complaints across some cities. In Europe, 22 majors representing cities (London, and Barcelona) want to increase regulatory control to the short-term rental option. Restrictions, bans, caps on days to rent are common reactions from authorities

Tax Liabilities: The company collects lodging taxes that they distribute to local authorities. The cost of doing business can certainly change with new tax liabilities currently underplay such as digital platform revenue-based taxes targeting online sharing/marketplace platforms. This can potentially increase prices for guests and deter hosts from participating due to costs

Large Debt: Company has an outstanding debt of ~$2.0 billion as of 09/30/2020

Team:

The company is still founder based and is composed of the following key members:

Brian Chesky, Co-Founder and CEO:Brian is a designer at heart graduating with a Bachelor of Fine Arts from Rhode Island School of Design.

Joseph Gebbia, Co-Founder and Chariman of Board and Samara: Joseph leads Samara, in-house design, and innovation studio. He has dual degree in graphic design and industrial design from Rhode Island School of Design.

Nathan Blecharczyk, Co-Founder and Chief Strategy Officer and Chairman of Airbnb China: Nathan received his Computer Science degree from Harvard and held several engineering roles before co-founding Airbnb

Executive talent beyond the founders spans from engineers at Alphabet (Google) to great leadership from Disney.

Equity ownership is mainly concentrated in two key groups: Three Founders - 43.8%, Sequoia Capital – 16.6%,

Financial Performance:

The company is aiming to raise $1 billion (SEC) to $3 billion (Analysts) in its IPO debut potentially at the end of November. In the previous two private raises, the company’s stock was ranged between $52.55 - $62.30 to raise $2 billion. The company has 263k outstanding shares as of 09/30/2020 and the assumed share price from previous private rounds puts it at a conservative valuation of $16 billion. There is speculation that the company could be worth $30 billion.

The company has achieved $4.8 billion in revenue for the year 2019, a 29.7% YoY over the $3.7 billion earned in 2018. As of nine months ended September 30, 2020, the company achieved $2.5 billion representing a (-32.4%) decrease YoY from $3.7 billion over the same period and currently holds $4.5 billion in cash. The decline in revenue by $1.2 billion was primarily driven by a (-42%) decrease in the number of check-ins during the Covid pandemic.

As of 12/31/2019, and 2018, Airbnb has yet to be profitable with net losses of -$674 million and -$16 million. In addition, in September, the Company received a Draft Notice of Proposed Adjustment from the IRS which could result in additional income tax expense and cash liability of $1.35 billion.

Airbnb however is showing signs of recovery post-Covid. In 2019, on average 81 million quarterly nights and experiences booked. In 2020, Q2 experienced 28 million booked while Q3 increased to 61.8 million. Similarly, Gross Booking Value in 2019 averaged $9.5 billion a quarter while in 2020 experienced a significant drop in Q2 to $3.2 billion and a recovery in Q3 to $8.0 billion.

In Q3, guests are showing resilience and desire to travel as well with shifting trends. Domestic traveling with shorter distances is increasing and specifically across smaller cities and destinations.

Airbnb plans to continue growth through the following strategies:

More Hosting: Company plans to extend new opportunities regarding long-term stays. The company plans to also invest in providing tools that offer host training and education

Global Network expansion: Penetration is low in India, China, and Latin America. The product will become more localized to attract hosts and guests such as their brand in China, Aibiying

Design new products and offerings: Features that support emerging travel trends such as local travel and remote working are essential (Airbnb online experience).

-Igli

You can access and download the detailed report which will include the summary and a company info-graphic for your records.

If you like the content please make sure to share this newsletter, share this post, or subscribe (if you have not already)!

Additional resources for all the Equity Contrarians (Leeeetttsss Gooooooo!!!)

Airbnb One Page Infographic

Airbnb Company Filings

Airbnb TechCrunch Articles

Airbnb Founder Letter

Airbnb IPO Bloomberg

Share this post