Welcome to Equity Breakdown, where you will find short, no bullshit overviews of public companies! If you would like to receive it directly in your inbox, subscribe now!

To all the Equity Contrarians,

One thing that is certain after this pandemic, is that consumers purchasing behavior is permanently shifting online. As e-commerce is exploding, key features such as trust, transparency, frictionless spending, and consumer analytics will propel certain Fintech players to dominate the $5.4 trillion global e-commerce market. There is a company that will be going public in December, co-founded by a former co-Founder of Paypal, that claims to be have the exact recipe for success in the lending space. Tonight we will breakdown Affirm, (AFRM), a company that wants to transform the way consumers buy and merchants do business.

Business Summary:

Affirm is a fintech company that provides installment loans at point-of-sale purchase for US Consumers. In fact, I was on the verge on purchasing a Peloton bike thanks to Affirms special offer, 0.00%, 39 months, $48.59/mo, but my impulse was tamed. The company offers online and mobile platform for lending and credit services for customers to purchase items and pay over period of months. The company wants to accomplish three goals with their technology:

Deliver trust and transparency

Responsible and confident spending for consumers

Fluid conversions and sales growth for merchants

Platform Features: Affirms platform consists of a point-of-sale payment solution, merchant commerce solutions, and consumer-focused app. The following features are present:

Consumers:

Integrated Checkout – pay overtime with 0% interest

Virtual Card – widely accepted payment method

Split Pay – built fixed payment plans with specific time frames for purchases under <$250

Market Place – Personal product recommendations

Savings – Insured interest-bearing account

Merchants:

Merchant dashboard: highlights transaction data, manage charges, review analytics on product performance and consumer purchasing behavior

Brand Sponsored Promotion: Suppliers can provide brand-specific promotions and offers can be personalized based on consumer analytics

Integration: Direct API, provides smooth site integration into payment and product pages with dedicated support team.

Technology: The tool leverages rich data landscape from deep behavioral, financial, shopping, and payment data as well capabilities such as fraud detection, credit check functionality, and pricing.

The company’s mission is “to deliver honest financial products that improves lives”.

Industry:

Commerce is experiencing transformation from positive effects of technology. The simple interaction between consumers and merchants are now changing after years of limitations. In the past, consumers experienced complex payment options, opaque fees and penalties, and lack of flexibility to complete or tailor purchases. Merchants on the other hand were also limited to offering consumer friendly solutions, discounts were not used based off data insights resulting in loss of brand value, and they received no benefits from old legacy payment networks. New trends have now emerged in the industry tackling the problems faced in the past

“Buy now pay later” market expansion: People want flexible payment options. Based on Wordplay’s 2020 Global payments report, “buy now pay later” is the fastest growing e-commerce platform. In 2023, it is expected to be 3% of the ecommerce payments. In EMEA, it already accounts for 6% of the e-commerce payment network, with expected growth to 10% by 2023.

Gen Z and Millennials: 25% of Millennials do not carry credit cards. Over 160 million people in the category prefer to build relationships with brands and receive engagement. According to a Harris Poll in 2020, 64% of Americans aged between 18 – 34 years prefer financial products through a technology platform.

Market Opportunity:

Online sales grew 20% to $3.4 trillion in 2019 and accelerated in 2020. By 2023, it is estimated to grow to $5.8 trillion. E-commerce represents 14% of total retail sales and in 2020 it has jumped to 16%. Based on Statista, 70% of Millennials prefer shopping online as well. This market is prime for growth and Affirm is positioned to take a position. The TAM is broken out in a couple of segments:

E-Commerce: $600 billion dollar market opportunity with potential expansion to $1 trillion by 2023.

Omni-Channel: $7.6 trillion was processed by credit cards in 2019. Virtual card and consumers being able to pay in store with application will shift this opportunity.

Merchant Marketing: According to B2B Lead, $1 trillion is spent by merchants to acquire customers.

Business Model Landscape:

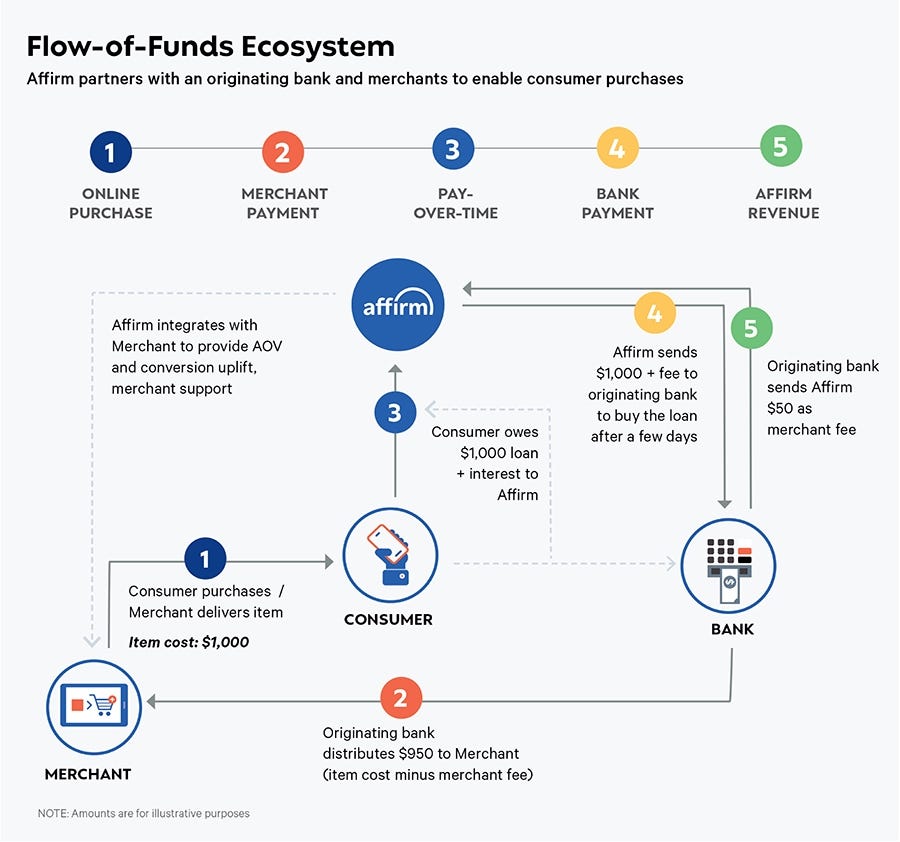

Affirm earns revenue from both merchants and consumers.

Merchants: Affirm receives a fee conversion of sales and offering of payment options. This revenue stream amounts to ~50% of revenue.

0% APR financing represented 43% of GMV

Consumers: Affirm receives interest revenue on loans that are purchased from their partnered banks and currently amount to ~37% of revenue.

Consumers are not charged deferred, compounding interest fees, late fees, or penalties.

Interchange fee from the use of Virtual cards which represented 4% of revenue

Bank Loans: The company generates ~9% of revenue from gain on sale of loans.

The following customer landscape is created through Affirm’s platform:

Consumers:

The company has 6.2 million consumers as of 09/30

47.8% are Millennials, Gen X (32.3%), Baby Boomers (12.4%), and Gen Z (6.8%)

3 million out of 230 million Millennials participating in the platform

68% of consumers accessed Affirm through mobile device

Merchants:

6,500 merchants integrated

Merchant base has expanded by 84%

Dollar-based merchant retention has exceeded 100%

Customers are concentrated in industries such as, sporting goods, furniture and homewares, travel, apparel, accessories, consumer electronics, and jewelry (Neiman Marcus, Peloton, Inntopia, NutriBullet, Bonobos, Shopify, Eventbrite, and etc)

Competitive Strengths (Moats):

Affirm has classified a series of core strengths to dominate the lending space:

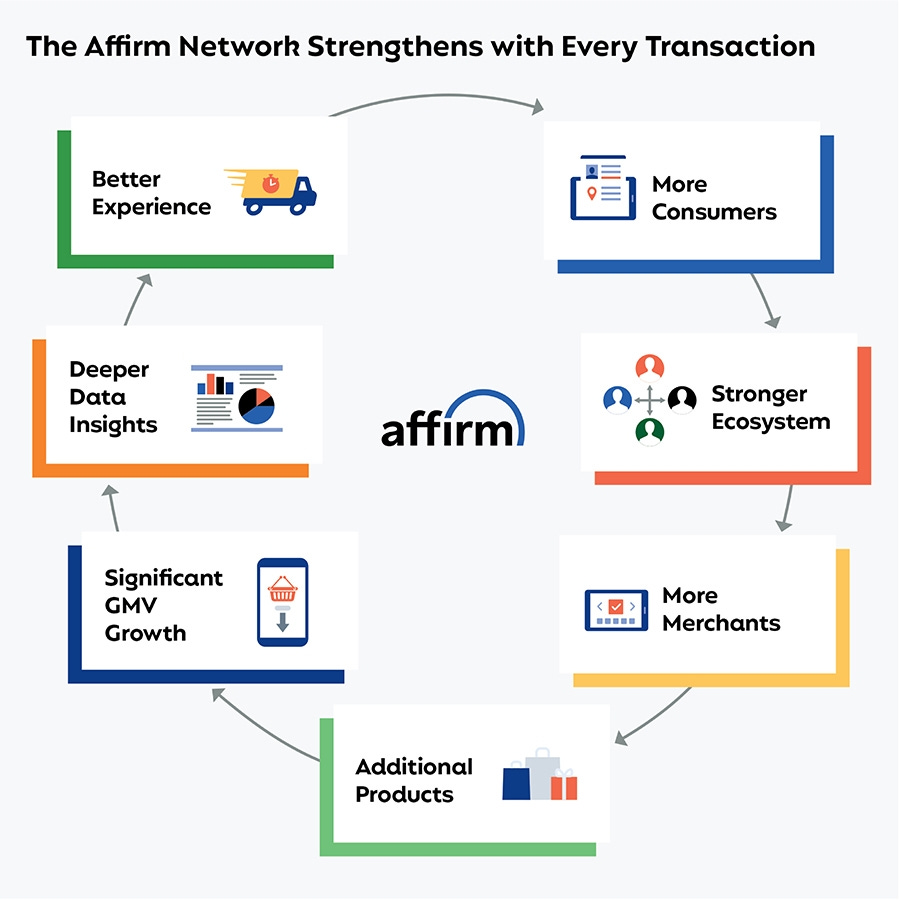

Network Effects: As consumers increase in using Affirm, merchants will gain significant value by understanding consumer insights. This will attract more merchants to participate. As more merchants integrate, better solutions are offered which attract more consumers. The ecosystem expands resulting in increased efficiencies.

Engineering Team: 47% of the employees are in technology or engineering related roles. Affirm can be easily integrated through their direct API regardless of the size of customer. Additionally, they designed their own ledger “to handle point-in-time reporting on millions of concurrent simple interest obligations. “

Proprietary Risk Models: The company prides itself on assessing risk better than competitors at a transaction level. The company approves 20% more customers than competitors and resulted in a weighted average delinquency rate of 1.1%. The company can quickly and accurately assess, price, and manage risk.

Technology Infrastructure: The infrastructure to source, aggregate, protect, and analyze data is considered a moat. The company uses 7.5 million loans and 6 years of repayments to train their models. The company can leverage SKU-level data and with their claims on ML capabilities can detect fraud, price rick, and offer custom solutions to consumers.

Competition/Risks:

The company has highlighted certain competitive and operational risks that may affect its performance.

Competition: The company’s primary competition is legacy payment methods, such as credit and debit cards, mobile wallets, and other pay-over-time solutions

JP Morgan, Bank of America, Capital One, PayPal, Afterpay, and Klarna

Revenue concentrated in one Merchant Partner: Top merchant partner, Peloton, represented almost ~28% of total revenue. Top 10 Merchants represent 35% of revenue. If the home fitness trend fades this can severely impact Affirm.

Agreement with Originating Bank Partners is non-exclusive and short term: Cross River Bank originates a substantial amount loans that are present in the platform. The current loan program agreement ends in Nov. 2023 and they do not prevent the bank from working with competitors.

Funding Sources are key to supporting Affirm Network: Capital efficient fund model is key to provide a successful commerce platform. If funds seize due to economic conditions or loss of banking relationship, then Affirm cannot offer the flexible payment solutions that are core to its business.

Team:

The company is still founder based and is composed of the following key members:

Max Levchin, Founder and CEO:Prior, Mr. Levchin co-founded PayPayl and served as Chief Technology Officer. He then founded Slide, a personal media sharing service, and Glow, a women’s health company.

Libor Michalek, President, Technology: Prior, Mr. Michalek served as Engineering Director at Youtube and Google and Chief Technology Officer at Slide.

Sandeep Bhandari, Chief Risk and Strategy Officer: Prior, Mr. Bhandari served as Chief Credit Officer at LendingClub Corporation.

Financial Performance:

The company has yet to release its target raise during its IPO debut but based on some past rounds we can see an increasing pattern. In 2019 the company raised $300 million at a weighted average of $13.18. More recently in their Series G, they raised $500 million at a weighted average share price of $19.93. With current outstanding shares this puts the speculative value of the company between $2.3 billion to $3.3 billion.

The company has achieved $509.5 million in revenue for year fiscal year ending 06/30/2020, a 93% YoY over the $264.4 million earned in fiscal year ending 06/30/2019. For the three months ended September 30, 2020 the company achieved $174.0 million representing a 97.9% increase YoY from $87.9 million. As of 06/30/2020, and 2019, Affirm has yet to be profitable with net losses of -$112.6 million and -$120.5 million.

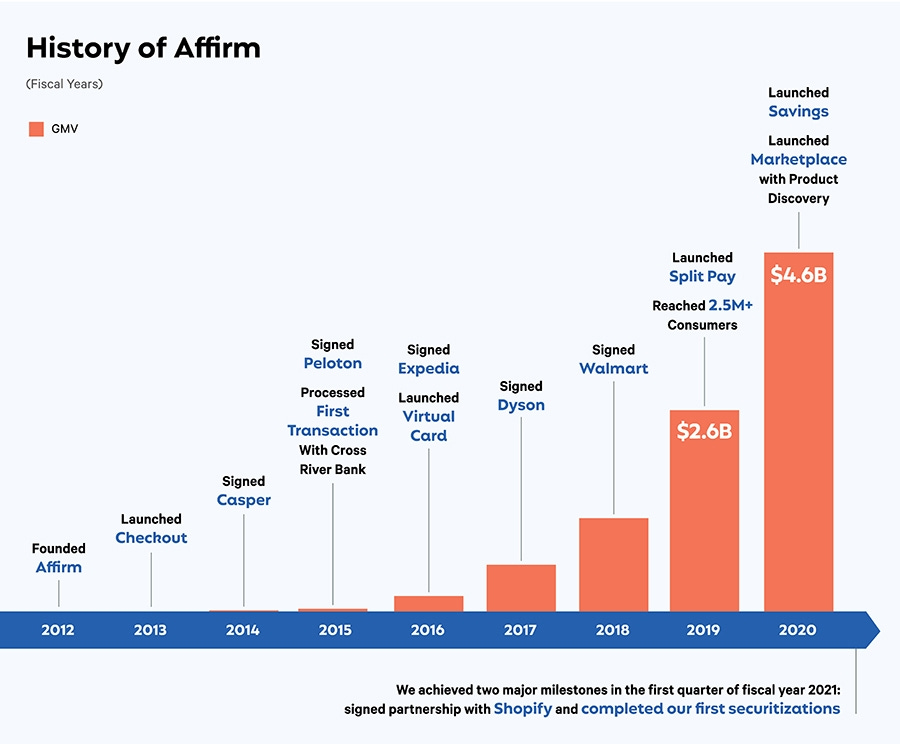

Affirm however is showing significant growth. The Gross Merchandise Volume (measures volume of transactions) as of FY 06.30.20 increased by 76.9% from 2018 to $4.6 billion and 626% from 2017. The company also uses a key metric known as contribution profit to highlight growth unit economics of their transactions in their platform. As a result, they remove technology, data analytics, sales, and marketing, general administrative, and loss on loan purchase amount expenses from their operating loss. This results in a $180 million (3.9%) contribution profit over the $4.6 billion gross merchandise volume in 2020.

Affirm also has experienced increased customer engagement with 77% increases YoY in 2020. Transactions per active consumer has slightly increased as well. Based on the most recent consumer base, repeat consumers spent an additional $2.2k in the next 12 months after making their first purchase on Affirm.

As mentioned, the company does depend on funding relationships with banking partners to continue scale and ensure low consumer acquisition. To date they have $4.2 billion of funding capacity.

Affirm plans to continue growth through the following strategies:

1. Expand to Higher Frequency Purchases:

Consumer Reach: Increase brand awareness through different channels with additional customer features such as managing debt obligations as well.

Merchant Reach: Affirm will be working with Shopify so U.S. merchants can offer buy now, pay later to their customers from a B2B perspective.

2. Expand to New Markets in Asia

-Igli

You can access and download the detailed report which will include the summary and a company info-graphic for your records.

If you like the content please make sure to share this newsletter, share this post, or subscribe (if you have not already)!

Additional resources for all the Equity Contrarians (Leeeetttsss Gooooooo!!!)

Affirm One Page Infographic

Affirm Company Filings

Affirm Blueprint (Medium Article)

Affirm Pitchbook Analysis

Affirm Company News

Share this post